- Policies and Basic Concepts

- Risk Management System and Relevant Organizational Units

- Identifying and Addressing High-Priority Risks

- Crisis Management and Business Continuity Plans

Policies and Basic Concepts

With approximately 70 bases across 19 countries outside Japan, and four business segments operating globally, the Inabata Group is exposed to various risks. These risks include unforeseeable uncertainties, and may have an impact on the performance, share price, financial position, and other aspects of the Group in the future.

Recognizing risk management as an important issue for management, we establish and administer risk-related rules and regulations, such as credit management rules, export management rules, and product management rules, and others, with our Risk Management Office at the core. For Group companies in Japan and overseas, the Head Offices execute appropriate risk checks pursuant to the Group company management rules and establish and administer separate operational rules for trading subsidiaries and manufacturing bases in multiple languages to prepare for risks that may arise from day-to-day operations.

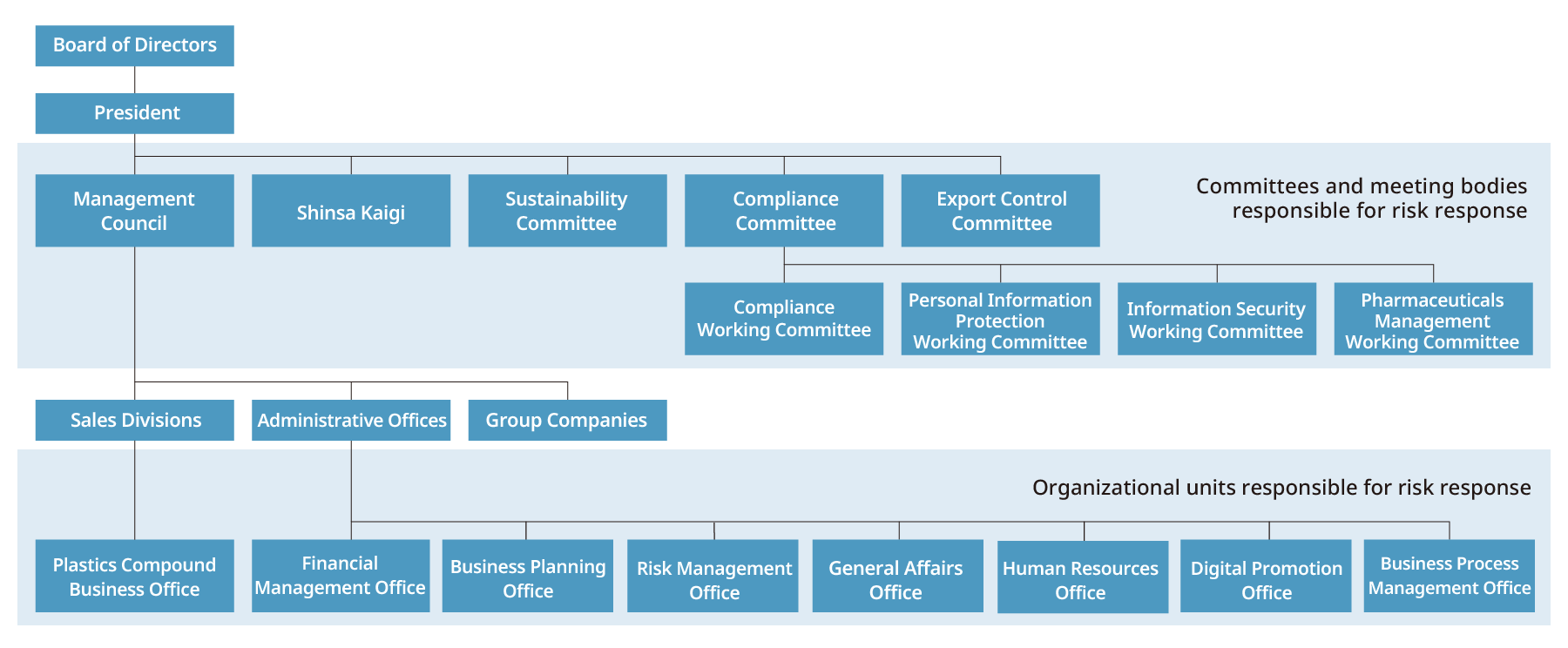

Risk Management System and Relevant Organizational Units

To prevent and address various company-wide risks, each responsible organization which manage various risks continuously monitor and relevant committees, and meeting bodies work together to promote risk management that enables us to appropriately address risks.

Each organization reports important matters to the Board of Directors as needed.

The Board of Directors oversees high-priority company-wide risks in an integrated manner, taking into account other risks reported by committees and responsible organizations.

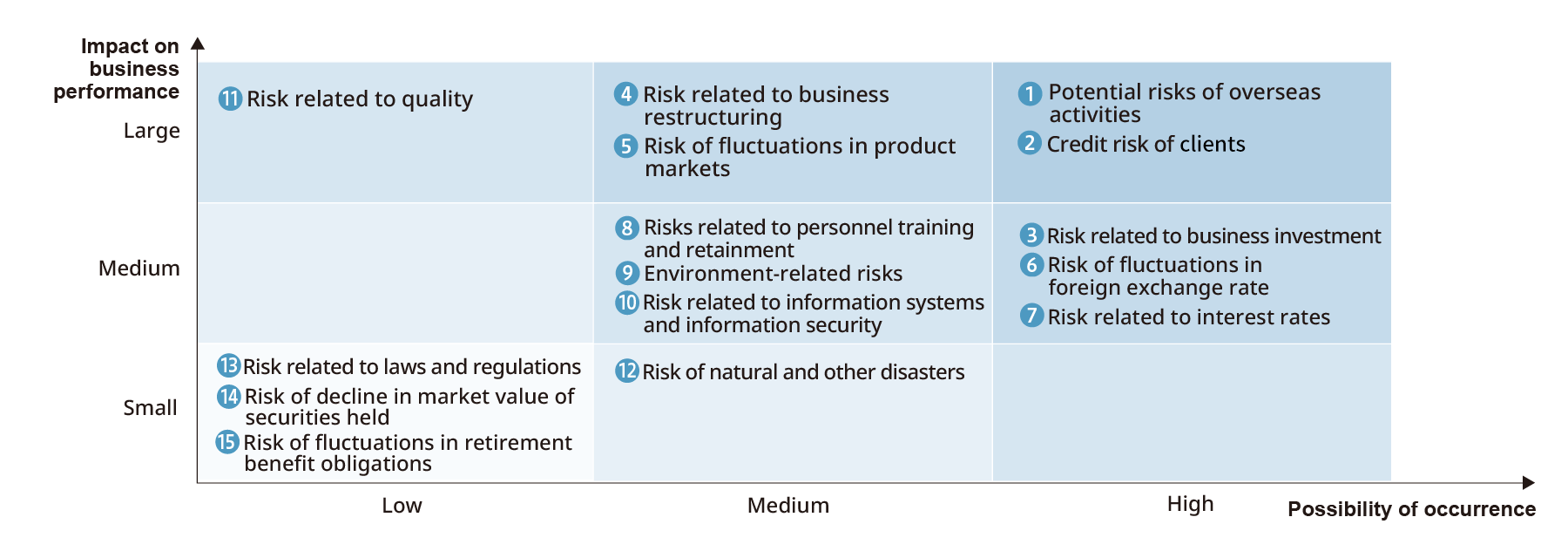

Identifying and Addressing High-Priority Risks

We have identified the 15 risks shown in the below risk matrix as the main risks faced by our Group. Mapping has been done on the matrix based on the probable impact of each risk on the Group' s business performance and the possibility of its occurrence using the responses on risk awareness of managers in the effectiveness evaluation of the Board of Directors conducted in FY2023 and other factors.

Primary Risks Confronting Our Group

1. Potential risks of overseas activities

Our Group' s production and sales activities overseas cover multiple regions, including Southeast Asia and Northeast Asia, North America, and Europe. There are inherent risks in operating in these foreign markets, which include unexpected changes in laws or regulations, adverse political or economic factors, difficulty in recruiting and retaining personnel, underdeveloped technological infrastructure, potentially adverse tax consequences, and social disruptions due to other factors.

To ensure that we can reduce such risks, we have established a framework for adapting swiftly to changes, and we carefully monitor laws and regulations throughout the world, environmental laws and regulations, and trends among society and our business partners.

For sales in the consolidated fiscal year by region, Asia accounted for 47% of the total, having the largest influence on our business.

We have formulated and are implementing business continuity plans (BCP) at our major overseas bases to serve as countermeasures for emergencies such as infectious disease outbreaks.

Relevant organizational units: Risk Management Office, Financial Management Office

2. Credit risk of clients

Our Group companies grant credit to many clients in Japan and abroad. Although we carry out credit management on a global scale, including our overseas clients as well, we cannot guarantee full collections. Therefore, there is a risk of adverse impact on our Group' s financial position and business performance due to the aggregation of bad-debt losses and allowance for doubtful accounts through bankruptcy and civil rehabilitation procedures and so on from contingencies concerning clients.

As of the end of the consolidated fiscal year, the Group' s notes receivable-trade and electronically recorded monetary claims operating were 31,198 million yen, accounts receivable-trade were 175,264 million yen, and inventories were 85,068 million yen, the total of which accounted for 68% of total assets. Screening for credit of significant importance is conducted by the Shinsa Kaigi, which is composed of members of management and holds discussions on investments, loans, and credit projects. With regard to accounts receivable-trade and inventories, we monitor and manage the balance of each consolidated Group company on a monthly basis.

Relevant organizational units: Risk Management Office

3. Risk related to business investment

When developing business at the Inabata Group, in many cases, we make investments and acquire equity in a joint enterprise or joint venture. Notably, with respect to our investments in consolidated affiliates, there is a risk that the Group' s financial position and business performance could be adversely impacted by trends in the financial status and performance of such Group companies.

In principle, our Group invests in minority interests with the main objective of expanding the shosha trading business, and limits the risks and amounts for investments in majority interests.

In addition to focusing on the "intensification of investment targeting future growth" as a priority initiative in NC2023, we have also established a department specialized in M&A. For investment projects of high importance, this department collaborates with each sales division and evaluates and analyzes risks from a quantitative and qualitative perspective. Projects are then deliberated on by the Shinsa Kaigi, which is composed of members of management. After the execution of investment, risks are monitored regularly, and appropriate measures are taken for projects that do not meet an established criteria.

Relevant organizational units: Risk Management Office, Business Planning Office

4. Risk related to business restructuring

In order to promote business selection and concentration, our Group continues to restructure its business by withdrawing from unprofitable businesses and selling or reorganizing subsidiaries and affiliates. These measures may adversely impact the performance and financial condition of our Group. We may be unable to execute our business restructuring plans in a timely manner due to factors such as government regulations and employment issues in each country. There is no guarantee that the Group will be able to achieve all or part of the original objectives through the implementation of business restructuring. We have established criteria for considering withdrawal from businesses, and hold deliberations on withdrawal, etc., from the relevant Group companies at the Shinsa Kaigi.

Relevant organizational units: Risk Management Office

5. Risk of fluctuations in commodities markets

Many of the information electronic materials, chemical raw materials, food products, and plastics handled by our Group are impacted by fluctuations in commodity prices. Failure to respond flexibly to market fluctuations could adversely impact the financial position and business performance of our Group. Each sales division gathers market information, monitors price trends, and thoroughly manages inventory.

In the consolidated fiscal year, in the food business of the life industry business segment, where we carry out inventory transactions, we were impacted by a drop in prices of processed marine products and other products for Japanese food in the U.S. market.

Relevant organizational units: Financial Management Office, each sales division

6. Risk of fluctuations in foreign exchange rate

Our Group engages in the production, sales, and trading of products and materials for overseas business development. In principle, we conduct hedging transactions through measures such as forward exchange contracts. However, we may be impacted by exchange rate fluctuations associated with foreign currency-denominated transactions. Furthermore, we convert items (including sales, expenses, and assets in each region) denominated in local currencies into Japanese yen for the preparation of consolidated financial statements. Consequently, the exchange rate at the time of conversion may impact the value after conversion into yen.

For the consolidated fiscal year, foreign exchange losses were 204 million yen, and foreign currency translation adjustment was 28,541 million yen.

Relevant organizational units: Financial Management Office

7. Risk related to interest rates

The Group raises capital for its operating activities and business investments through means such as borrowing from financial institutions or issuing corporate bonds. We ascertain interest rate trends in Japan and overseas, manage interest rate risk by adjusting the ratios of funds procured from fixed-rate sources and floating-rate sources, and work to reduce interest expense. However, a sharp rise in interest rates could adversely affect the Group' s financial position and business performance.

In the consolidated fiscal year, interest expenses were 1,873 million yen.

Relevant organizational units: Financial Management Office

8. Risks related to personnel training and retainment

Given that our Group' s core business is shosha trading, human capital is the most important asset and source for creating value for us. So that we can sustainably improve our corporate value, we need to train and retain diverse outstanding human resources that have expertise in core operational areas such as management, finance, and IT, as well as the four business fields we operate in, at our locations in Japan and overseas.

Regarding the training and strengthening of our human capital as an important management agenda, we are progressively enhancing our internal system to train and retain personnel that will lead our efforts to create value. However, the declining birthrate, aging population, and increasing job mobility may make it difficult to fill our talent needs or become a hurdle in training personnel. In such cases, the Group' s financial position and business performance could be adversely affected.

9. Environment-related risks

Our Group handles a wide range of products in four business fields in Japan and overseas. The manufacture and sale of these products may be impacted by factors including regional environmental regulations and changes to eco-friendly products. In addition, the plastics business may be impacted by the transition to plastic-free products. Alongside working to diversify suppliers, in each of our businesses, we are focusing on the sale of recycled products and other materials that reduce environmental impact to contribute to a decarbonized and circular society.

With regard to climate change-related risks, we endorsed the recommendations of the TCFD in April 2023 and are working to accurately ascertain the impact of climate change on our business and disclose related information.

Relevant organizational units: General Affairs Office

10. Risk related to information systems and information security

As we operate business as a shosha, or Japanese trading company, group, we hold confidential and personal information relating to our business partners and confidential and personal information relating to the Group. To ensure that this information is not leaked externally, destroyed, or falsified, we have established our Information Security Policy, prepared manuals that define information management procedures, and developed a Group-wide management framework. Based on this, we engage in thorough management practices, enhance information security, and implement employee education and other such measures. For our regulations and manuals, we review them continuously to adapt to new risks and technologies.

Moreover, given that remote work has increased with the advancement of work-style reforms, in addition to traditional antivirus software, we have introduced an endpoint security system that monitors the behavior of devices, thereby working to enhance security in alignment with a "zero trust" approach. To address security incidents, we have established an internal Computer Security Incident Response Team (CSIRT) to respond quickly and accurately and are strengthening information sharing both internally and externally. Security monitoring is also performed 24 hours a day, 7 days a week by an external security operations center (SOC). Nevertheless, as cyberattacks are becoming increasingly sophisticated, it is difficult to completely block unauthorized external access and other threats, and the Group' s financial position and business performance may be adversely impacted if such unforeseen events occur.

Relevant organizational units: Digital Promotion Office

11. Risk related to quality

While we are a shosha, or Japanese trading company, group, we also own companies involved in manufacturing and processing in a variety of fields, including plastic compounding, plastic film, materials for medical products, and processed marine products, in Japan and abroad. We conduct quality management to ensure the reliability and safety of the products manufactured and processed by these companies. As a shosha, we also procure a diverse array of materials and products from our business partners in the four business areas of information and electronics, chemicals, life industry, and plastics, and sell them to our customers. For these materials and products, we ascertain global changes in relevant laws, regulations, and standards related to the environment and safety, working to manage quality accordingly.

However, it is difficult to completely avoid quality issues, and if any arise and result in loss, the Group may be held responsible. In such an event, the Group' s financial position and business performance could be adversely affected.

Relevant organizational units: Risk Management Office, Plastics Compound Business Office, each sales division

12. Risk of natural and other disasters

If natural disasters, such as earthquakes, tsunami, or typhoons, or highly infectious diseases occur in a country or region where the Group operates, damage to Group employees, offices, or facilities may have an adverse impact on the Group' s business. Any supply chain disruptions, supply-demand fluctuations on the markets for our products, and other events caused by such disasters may affect the Group' s operating results and financial position. To prepare for the adverse impact of such disasters, we have formulated BCPs in accordance with our basic crisis response policy and, in the event of a disaster, will continue the business with the safety of our employees as our top priority. Nonetheless, it may not be possible to avoid all damage or negative influence, which could have an adverse impact on the Group' s business in the future.

Relevant organizational units: General Affairs Office

13. Risk related to laws and regulations

The Group is subject to various government regulations in the countries where we operate. These regulations include permits for business and investment, export restrictions due to national security concerns, customs duties, and other regulations on imports and exports. Failure to comply with these regulations may result in increased costs. Consequently, these regulations may have an adverse impact on the Group' s financial position and business performance.

As our overseas sales ratio for the consolidated fiscal year was high at 55%, regulations on imports and exports may have a significant impact on the Group. Therefore, we have established the internal Export Control Committee to reduce risks.

Relevant organizational units: Risk Management Office, Business Process Management Office

14. Risk of decline in market value of securities held

For reasons of business strategy, the Group subscribes for or invests in shares and other securities of numerous companies. The value of the securities we hold is at risk of impairment due to worsening trends in the stock market, or a deteriorating financial conditions at the investees.

In the consolidated fiscal year, we recognized 34,872 million yen in investment securities.

Relevant organizational units: Financial Management Office

15. Risk of fluctuations in retirement benefit obligations

The Group measures employee retirement benefit expenses and obligations based on the discount rate and other actuarial assumptions as well as on the expected rate of return on plan assets. If the actual outcome differs from these assumptions, or if these assumptions are changed, that will affect the amount of obligations recognized. In terms of profit and loss, these effects are accumulated and recognized ratably over future periods, and therefore generally have an impact on expenses to be recognized in future periods. In addition, plan assets are susceptible to share price fluctuations since listed securities are held in a retirement benefit trust. Pension costs for the Group have fluctuated due to profit and loss instability resulting from plan asset management and a decline in the discount rate. Falling share prices, further declines in the discount rate, or lower investment return on plan assets could adversely affect the Group' s performance and financial position.

In the consolidated fiscal year, the Group' s retirement benefit liability was recognized in the amount of 2,343 million yen.

Relevant organizational units: Human Resources Office, Financial Management Office

Responses to Other Risks

Tax compliance

All officers and employees of the Group strive to comply with laws and regulations as well as internal regulations, regardless of the country, to manage Inabata with a focus on compliance.

With regard to taxes, we recognize that one of our social responsibilities is to pay taxes according to related laws and regulations in each country or region and maintain transparency. We think that proper tax payment contributes to economic development of the country or region and in return results in sustainable growth of our Group and improvement of our medium- to long-term corporate value. Therefore, we strive to minimize tax risk and maintain as well as improve tax compliance.

Please refer to the relevant pages on our website for responses to the following risks related to sustainability:

Crisis Management and Business Continuity Plans

The Group has prepared crisis management protocols that set out responses to various crises that significantly impact the business, such as earthquakes, storms, floods, and other natural disasters, highly infectious diseases, terrorism, riots, crimes, accidents, misconduct, noncompliance, cyberattacks, and security incidents. We have a crisis management system in place whereby, if a crisis occurs, we set up a company-wide task force and local task forces to cooperate and respond under the management and supervision of the heads of each task force.

Pursuant to the crisis management protocols, we have formulated and introduced business continuity plans (BCPs) since 2018 to ensure continuity for the business, or early recovery and resumption of operations, should any crisis occur. We have also prepared a first response manual and other guidelines that place the highest priority on protecting and saving human lives.

In 2020, we suspended the formulation of plans at some bases due to the spread of the COVID-19 pandemic. However, in 2021, we organized issues identified during the pandemic and reviewed bases' completed plans, and in 2023, we began to work on BCPs again at the bases where formulation had been suspended. As a result, we are now managing formulated BCPs at 62 bases in Japan and overseas, covering the consolidated Group' s key bases. (As of March 31, 2024)

Confirm employee safety in disaster situations, and conduct regular drills for employees, such as earthquake drills, safety confirmation drills, and fire drills.