- Policies and Basic Concepts

- Summary of Responses by the Inabata Group

- Governance

- Strategy

- Risk Management

- Carbon Neutrality Declaration 2050

- Metrics and Targets

- Main Initiatives

Policies and Basic Concepts

Climate change is one of the most pressing issues facing global society. It is a highly urgent issue that seriously impacts people’s lives and the natural environment as seen in the unprecedented extreme weather events that are already occurring with greater frequency and intensity around the world. The Paris Agreement, an international treaty on climate change measures, aims to hold the increase in the global average temperature to well below 2℃ above pre-industrial levels and pursue efforts to limit the temperature increase to 1.5℃ above pre-industrial levels, and states that this requires achieving a balance between anthropogenic greenhouse gas (GHG) emissions and removals by the second half of this century.

The Inabata Group fully recognizes the effects of climate change and the need for countermeasures, and has made it clear that the Group strives to conserve the global environment through business activities in its Sustainability Basic Policy, Sustainability Code of Conduct, and Declaration of Compliance. When we announced materiality in June 2022, we highlighted “contributing to a decarbonized and circular society” and identified global environmental problems, including climate change, as one of the key issues for management.

We consider climate change a risk to the Group, but one that also presents business opportunities. Therefore, as well as taking steps to reduce GHG emissions, we seek to provide products and solutions that contribute to a decarbonized society.

Having endorsed the recommendations issued in June 2017 by the Financial Stability Board’s (FSB) Task Force on Climate-related Financial Disclosures (TCFD),* we work to develop appropriate understanding of the impact of climate change on our business activities and disclose the details of such impact.

*The TCFD was launched in 2015 at the request of the Group of Twenty (G20). Recognizing the significant impact that climate change will have on financial markets, the Final Report (Recommendations of the TCFD) released in 2017 called on companies and other entities to disclose information on the risks and opportunities presented by climate change.

Summary of Responses by the Inabata Group

| Core elements | Description | Inabata Group response |

|---|---|---|

| Governance | Disclose the organization’s governance around climate-related risks and opportunities. | Sustainability issues, including climate change, are deliberated and examined at the Sustainability Committee, which is chaired by the president. The Regulations of the Board of Directors require the director in charge of sustainability to report to the Board of Directors on the status of initiatives to address sustainability issues. The content of deliberations and examinations at the Sustainability Committee is also reported and escalated appropriately to the Board of Directors as part of the abovementioned process. |

| Strategy | Disclose the impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning. | Regarding the 4℃ scenario, whereas the Group’s bases in Japan and overseas are assumed to suffer damage due to intensifying extreme weather events, the risk is not estimated to be so great as to significantly impact business operations. In terms of opportunities, demand for products adapted to rising temperatures and changing weather patterns is expected to increase. Accordingly, it is concluded that the Group will be able to maintain its resilience. Regarding the 1.5℃ scenario, we identify the increase in operating costs due to carbon pricing introduction and steep rises in the electricity price as a risk. However, the risk is projected to be more than offset by gaining revenue opportunities from future growth in technologies and products that contribute to low-carbon economy and reduced environmental impact. We recognize once again the great relevance of expanding sales of products that reduce environmental load—which is part of our multi-faceted approach to markets with potential for future growth and steady monetization efforts, a key initiative under the New Challenge 2023 medium-term business plan—to our growth in the decarbonized society of the future. |

| Risk Management | Disclose how the organization identifies, assesses, and manages climate-related risks. | At the Group, the Sustainability Committee manages climate-related risks. The committee deliberates risks identified and examined from both qualitative and quantitative perspectives based on scenario analysis, and reports to the Board of Directors as necessary. The Board of Directors oversees Group-wide risks of high importance in an integrated manner, taking into account reports from the Sustainability Committee as well as other risks reported by the Risk Management Office, the Financial Management Office, the Compliance Committee, and other units. |

| Metrics and Targets | Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities. | To commit to achieving the global goal of limiting the increase in temperatures to 1.5℃ as stated in the Paris Agreement, the Inabata Group has set the long-term goal of carbon neutrality by FY2050 (covering Scopes 1 and 2 emissions of the consolidated Group). Since FY03/2022, we have calculated Scope 3 emissions in order to understand emissions for our entire supply chain. In the future, we will expand the scope of calculations and consider medium-term targets to achieve the long-term goal. |

Governance

Please refer to the System (Governance) section on the Environmental Management page.

Strategy

The Inabata Group strives to understand the business risks and opportunities arising from the transition risks and physical risks of climate change, and to reflect this in the formulation of climate change countermeasures and business strategies.

In addition to 2030, which is the year for achieving our long-term vision IK Vision 2030, the scenario analysis below assumes 2050, which is the year for achieving our carbon neutrality target. We consider both qualitative and quantitative aspects with reference to the 4℃ scenario, which assumes no implementation of more ambitious climate change measures and intensifying extreme weather events, and the 1.5℃ scenario (partly combined with the 2℃ scenario), which assumes implementation of more ambitious climate change measures aimed at decarbonization.

■Future forecasts based on climate-related scenarios

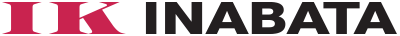

The world envisioned in the 1.5℃ scenario

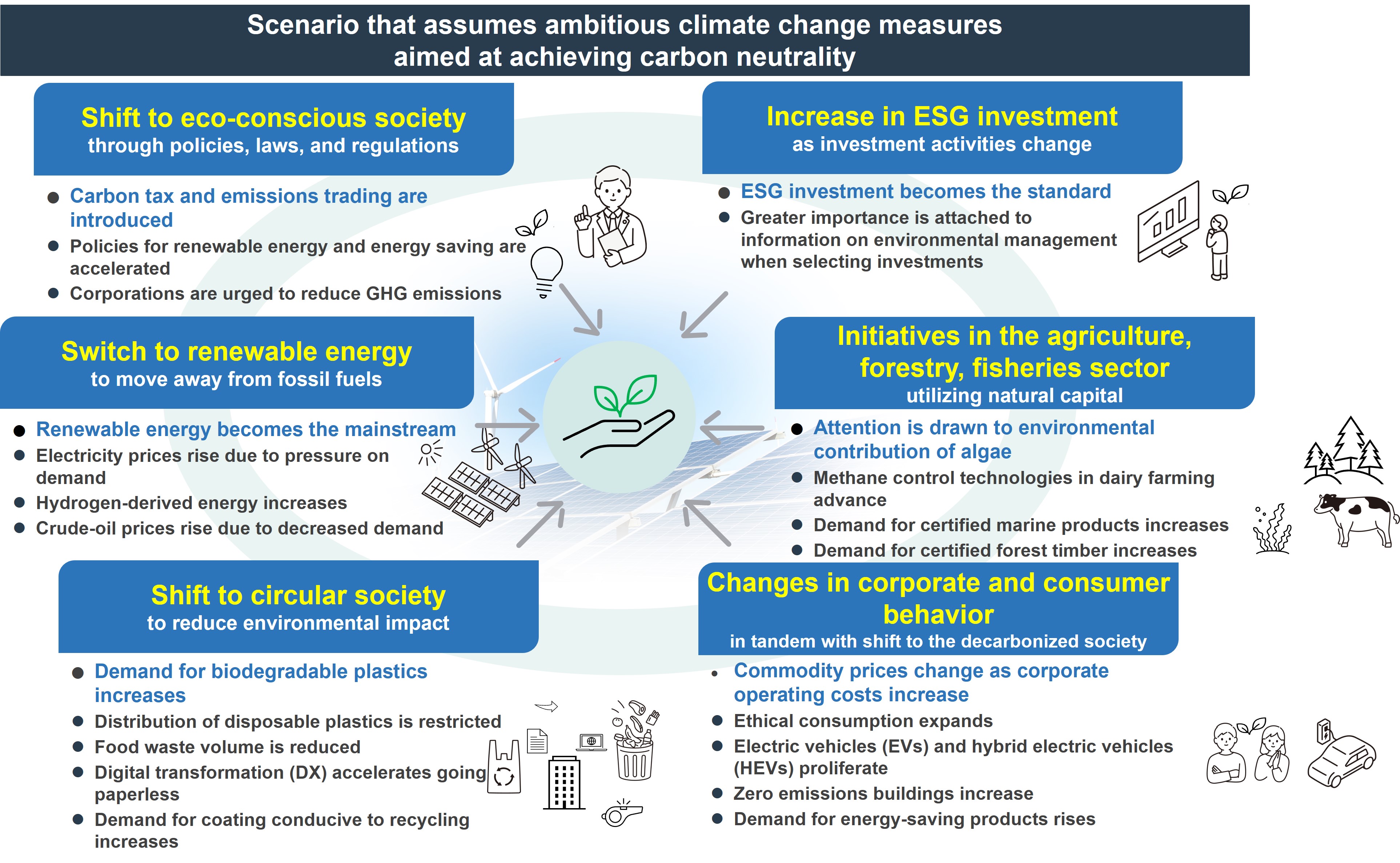

The world envisioned in the 4℃ scenario

- Reference scenarios

- 4℃ scenario: Stated Policies Scenario, International Energy Agency (IEA); and Representative Concentration Pathway (RCP) 8.5 scenario,

Intergovernmental Panel on Climate Change (IPCC). - 2℃scenario: Sustainable Development Scenario, IEA; and RCP2.6 scenario, IPCC.

- 1.5℃ scenario: Net Zero Emissions by 2050 Scenario, IEA.

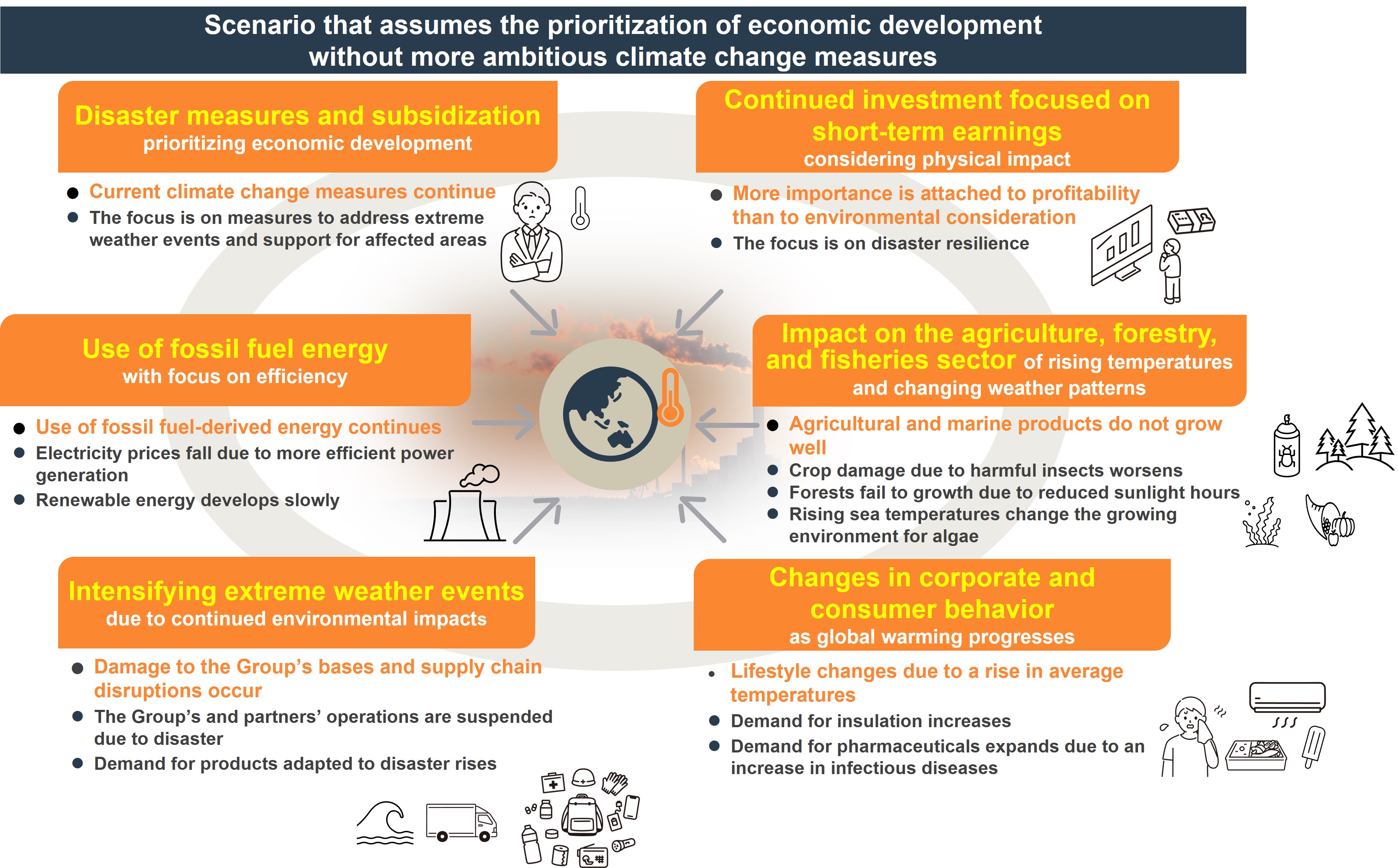

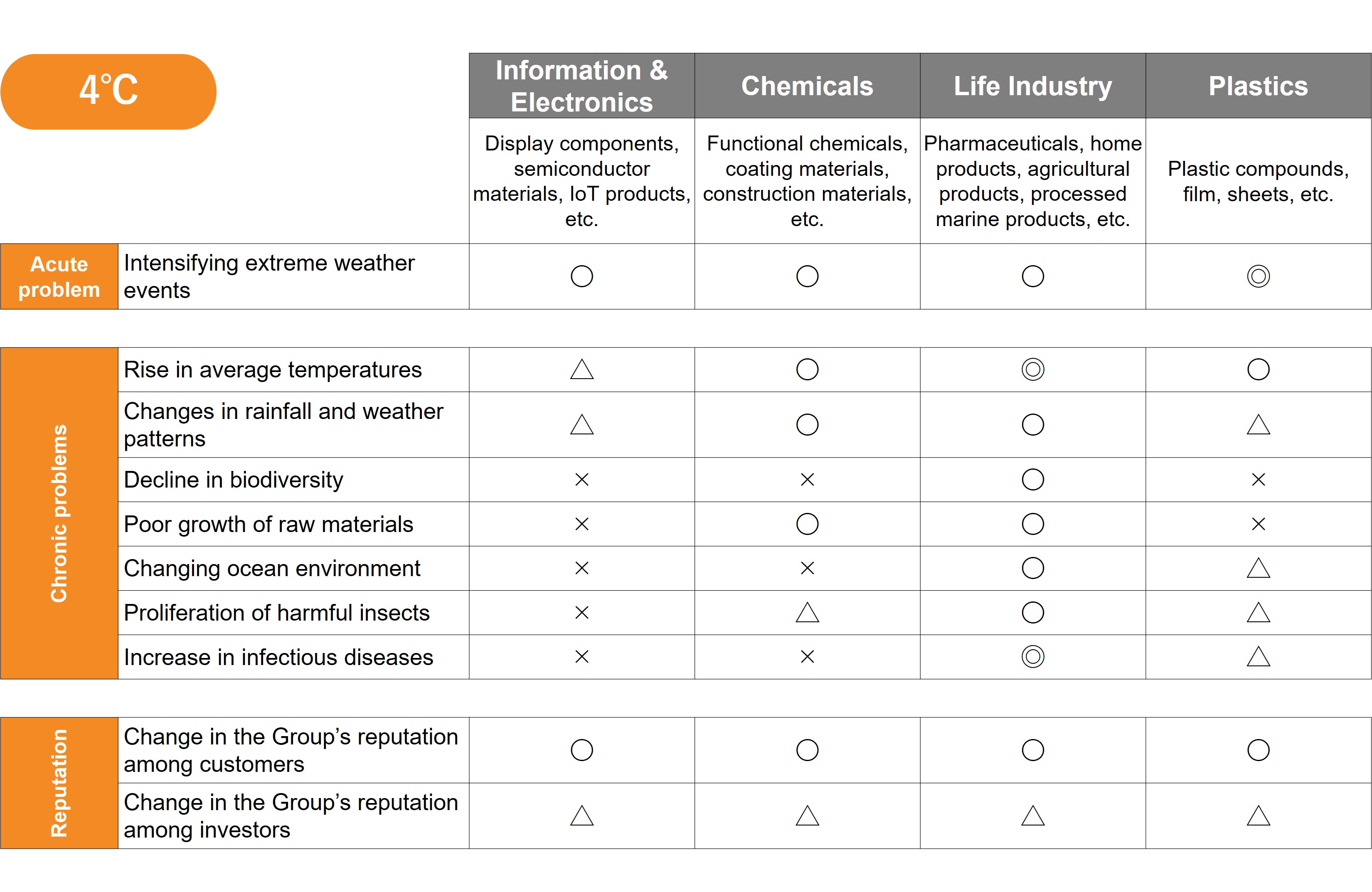

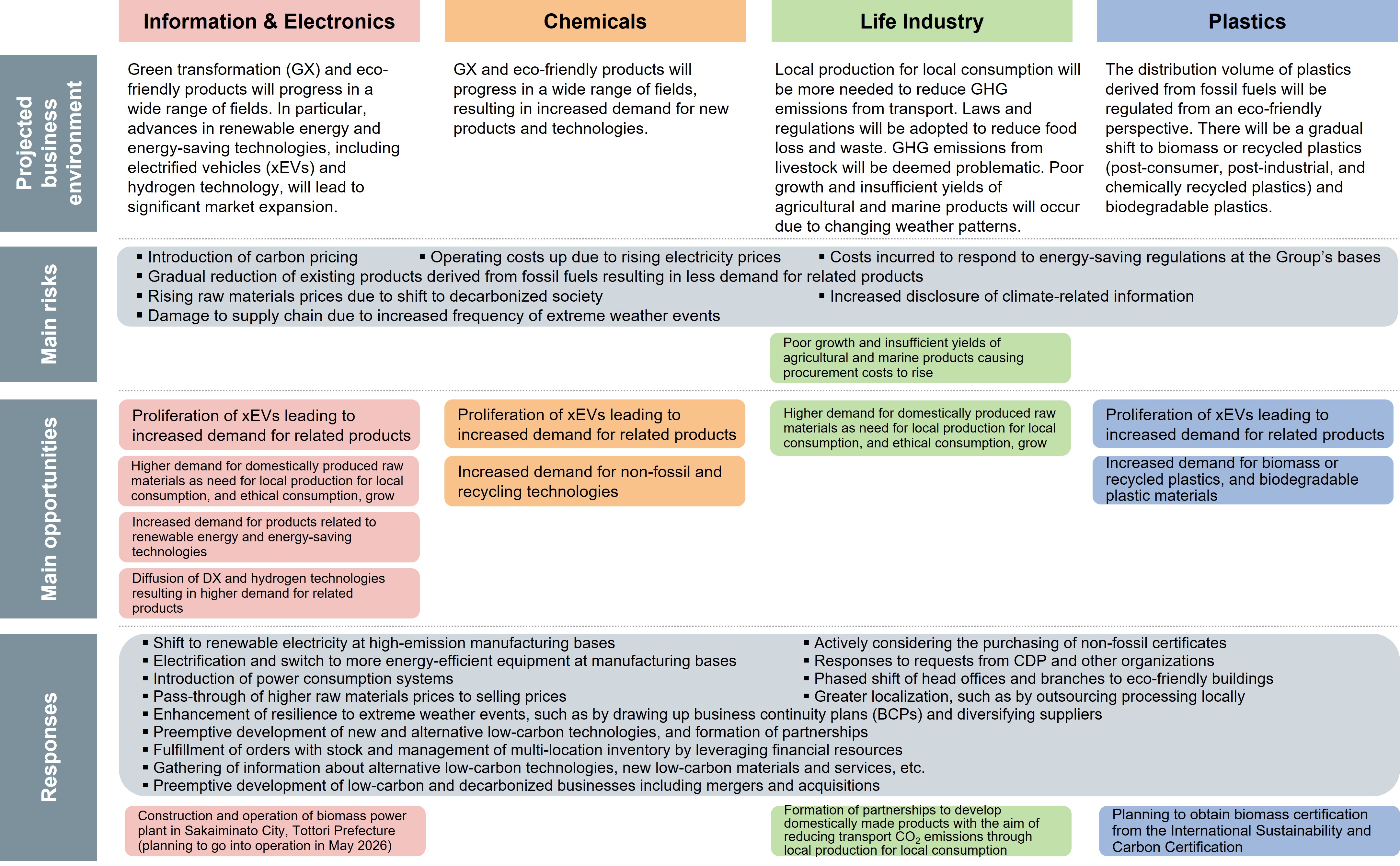

The Inabata Group operates in a wide range of businesses, with trading at the core. There are shared risks and opportunities, as well as different risks and opportunities, for each of the four business segments: Information & Electronics, Chemicals, Life Industry, and Plastics. Therefore, we have examined the relevance of climate-related issues to each business segment. The findings are summarized in the table below.

■Results of scenario analysis and key responses for each business segment (qualitative)

1.5℃ scenario

4℃ scenario

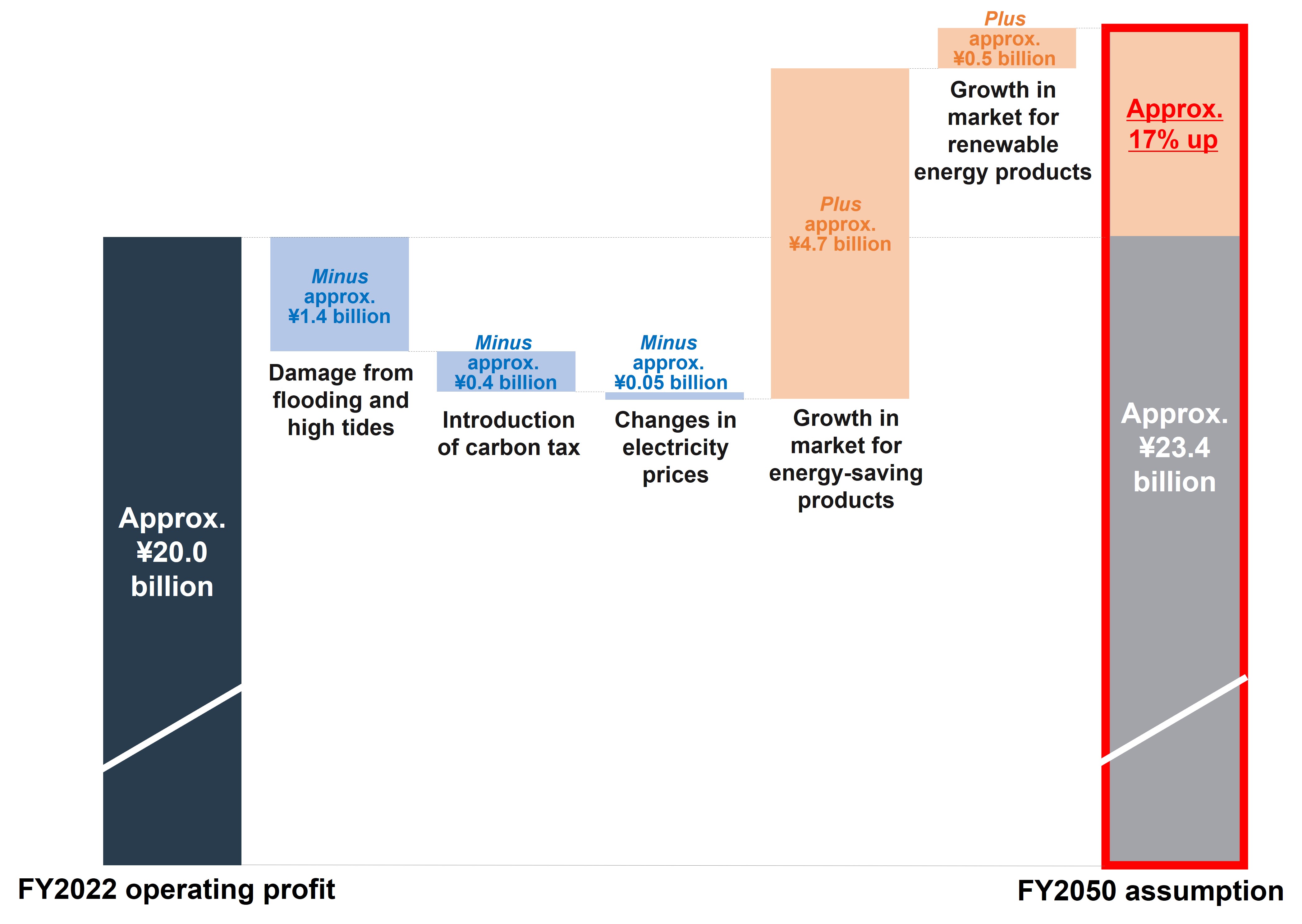

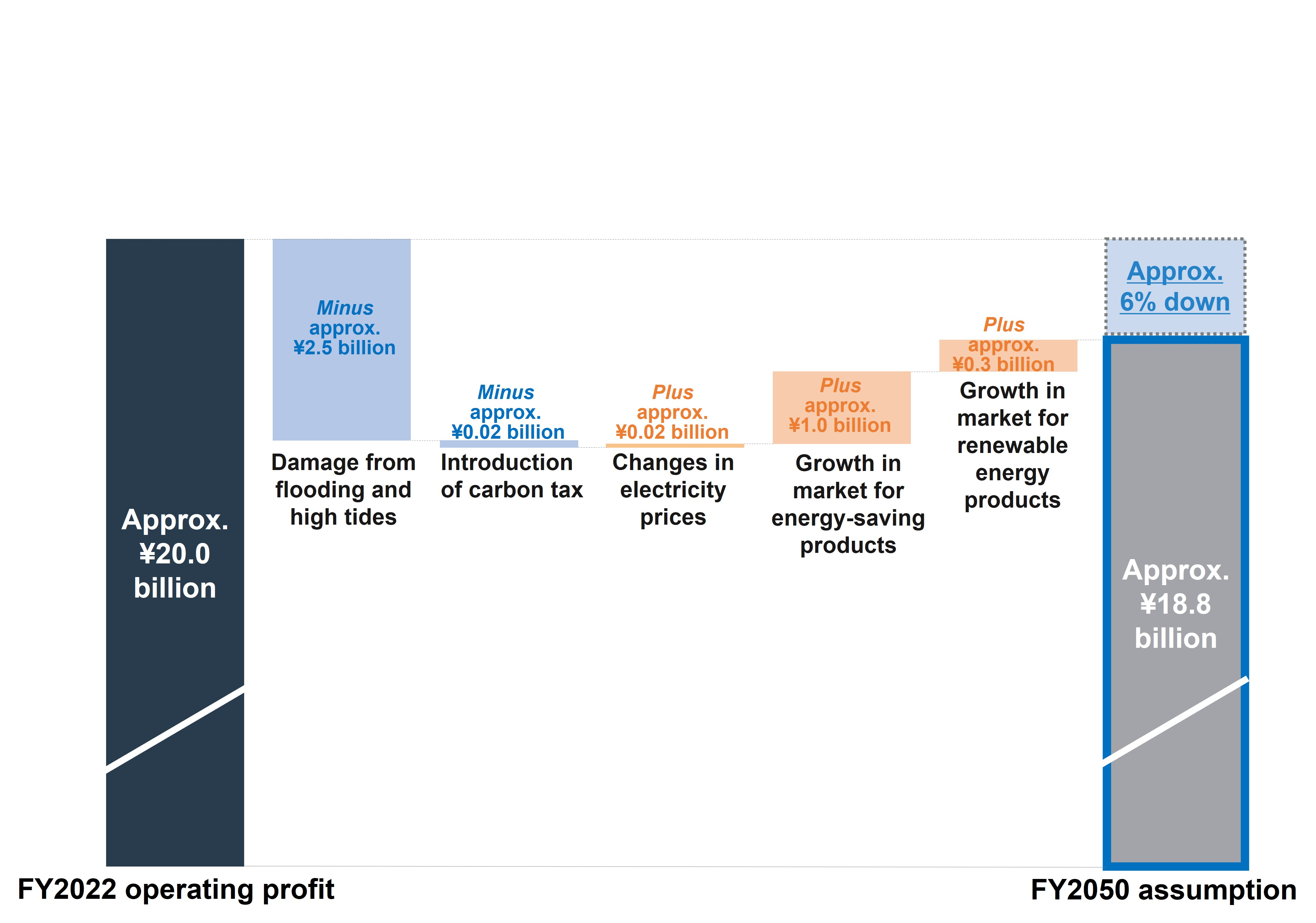

■Financial impact estimates

We have estimated the financial impact based on predicted values for the future.

Note that these financial impact estimates were obtained by narrowing down the scope of the analysis and establishing hypothetical situations based on the limited information and data available at this point in time.

Reference: Formula for the estimates

-

- Estimates based on GHG emissions by the Inabata Group and future CO2 prices.*1

(*1 Refer to values under the Net Zero Emissions by 2050 Scenario in the IEA’s World Energy Outlook 2021)

○ Carbon tax - Estimates based on power consumption by the Inabata Group and future electricity prices.*2

(*2 Refer to values under the Stated Policies and Sustainable Development Scenarios in the IEA’s World Energy Outlook 2019)

○ Electricity prices - Estimates based on projections of the Group’s related product sales as well as of future electrical capacity and market size for clean energy technologies.*3

(*3 Refer to Stated Policies, Sustainable Development, and Net Zero Emissions by 2050 Scenarios in the IEA’s World Energy Outlook 2021)

○ Diffusion of renewable energy and energy-saving products - Estimates of amounts of disaster damage at each Group base by reference to Manual for Economic Evaluation of Flood Control Investment by the Ministry of Land, Infrastructure, Transport, and Tourism. Damage information (rates of damage and number of days of business stoppage) for each base specified using the hazards map.

○ Physical damage from flooding and high tides - Estimates based on GHG emissions by the Inabata Group and future CO2 prices.*1

1.5℃ scenario

4℃ scenario

■Scenario analysis results

Regarding the 4℃ scenario, whereas the Group’s bases in Japan and overseas are assumed to suffer damage due to intensifying extreme weather events, the risk is not estimated to be so great as to significantly impact business operations. In terms of opportunities, demand for products adapted to rising temperatures and changing weather patterns is expected to increase. This has made us recognize anew the potential to contribute to society by helping society as a whole adapt to global warming while maintaining the Group’s resilience.

Regarding the 1.5℃ scenario, we identify the increase in operating costs due to carbon pricing introduction and steep rises in electricity prices as a risk. However, the risk is projected to be more than offset by gaining revenue opportunities from future growth in technologies and products that contribute to low-carbon economy and reduced environmental impact. We recognize once again the great relevance of expanding sales of products that reduce environmental load—which is part of our multi-faceted approach to markets with potential for future growth and steady monetization efforts, a key initiative under the New Challenge 2023 medium-term business plan—to our growth in the decarbonized society of the future.

Risk Management

At the Inabata Group, climate-related risks are managed by the Sustainability Committee as we believe that traditional risk management methods alone are insufficient to manage long-term impacts that include elements of uncertainty. The committee discusses risks identified and examined from both qualitative and quantitative aspects based on scenario analysis, monitors the progress, and reports to the Board of Directors as required.

Regarding Group-wide risk management, the Risk Management Office, the Financial Management Office, the Compliance Committee, and other units implement risk management by applying their individual expertise to analyze and evaluate risks related to partners, products, import and export, financial management, compliance, and so forth. Important matters are reported to the Board of Directors as needed.

The Board of Directors oversees Group-wide risks of high importance in an integrated manner, taking into account reports from the Sustainability Committee as well as other risks reported by abovementioned expert units.

In addition, each risk is assessed from the dual perspectives of assumed impact on performance and probability, as part of the annual Board of Directors effectiveness evaluation.

Carbon Neutrality Declaration 2050

In June 2022, the Inabata Group released the Carbon Neutrality Declaration 2050, which sets the goal of achieving net zero* GHG emissions from business activities by FY2050. Climate change is one of most pressing issues facing global society. There are calls for climate action worldwide, and moves towards decarbonization are accelerating in Japan and abroad. The Carbon Neutrality Declaration 2050 responds to global calls for climate action and declares that the Group will further accelerate climate change measures.

While we have already established an environmental management system compliant with ISO 14001 and implemented energy management and other initiatives, we will further strengthen decarbonization initiatives going forward to achieve carbon neutrality. We are also focusing our business activities on providing various products and solutions that contribute to a decarbonized society.

* Covers the amount of company emissions that fall within Scope 1 (emissions from the use of fuel by the company) and Scope 2 (emissions from the use of electricity and heat purchased by the company) of the Greenhouse Gas Protocol.

Metrics and Targets

Since FY2021, we have calculated Scope 3 emissions in order to understand emissions for our entire supply chain. In the future, we will expand the scope of calculations and consider medium-term targets to achieve the long-term goal.

Inabata supply chain emissions (FY2022)

| Inabata supply chain emissions | FY2022 | |

|---|---|---|

| GHG emissions [t-CO2e] |

Ratio of total [%] |

|

| Scope1*1 | 2,755 | 0.1 |

| Scope2*2 | 43,666 | 2.2 |

| Scope3*3 | 1,960,235 | 97.7 |

| Scope1,2,3 total | 2,006,656 | 100.0 |

| Scope 3 breakdown by category | GHG emissions [t-CO2e] |

Scope 3 ratio [%] |

||

|---|---|---|---|---|

| Upstream | Category 1 | Purchased goods and services | 1,435,020 | 73.207 |

| Category 2 | Capital goods | 2,984 | 0.152 | |

| Category 3 | Fuel- and energy-related activities not included in Scope 1 or Scope 2 | 71 | 0.004 | |

| Category 4 | Upstream transportation and distribution | 55,189 | 2.815 | |

| Category 5 | Waste generated in operations | 53 | 0.003 | |

| Category 6 | Business travel | 2,377 | 0.121 | |

| Category 7 | Employee commuting | 234 | 0.012 | |

| Category 8 | Upstream leased assets | Not applicable since the category is included in Scopes 1 and 2. | ー | |

| Downstream | Category 9 | Downstream transportation and distribution | Excluded from calculations since it is difficult to ascertain actual conditions and make reasonable estimates for the wide variety of products sold and of transportation destinations. | ー |

| Category 10 | Processing of sold products | Excluded from calculations since it is difficult to ascertain actual conditions and make reasonable estimates for the wide variety of products sold and of transportation destinations. | ー | |

| Category 11 | Use of sold products | Not applicable since there are no activities in this category. | ー | |

| Category 12 | End-of-life treatment of sold products | 464,242 | 23.683 | |

| Category 13 | Downstream leased assets | 64 | 0.003 | |

| Category 14 | Franchises | Not applicable since there are no activities in this category. | ー | |

| Category 15 | Investments | Not applicable since there are no activities in this category. | ー | |

- Scope of calculations

- Scopes 1 and 2: Inabata & Co., Ltd., and domestic and overseas consolidated subsidiaries.

Scope 3: Inabata & Co., Ltd.

- *1. Scope 1: Direct GHG emissions from Inabata’s own sources (burning fuel and manufacturing processes).

- *2. Scope 2: Indirect emissions from the use of electricity, heat, and steam provided by other companies, calculated based on market standards.

- *3. Scope 3: Indirect emissions other than Scopes 1 and 2 (emissions at other companies related to Inabata’s business activities).

Main Initiatives

We regularly distribute company newsletters and in-house circulars to educate employees about ways to conserve power when using lighting, business machines, air conditioners, and so forth. We also implement the Cool Biz casual dress code from May to October each year in an effort to set the office air-conditioner temperature at 28ºC. Since November 2020, we have made wearing neckties optional during working hours even after the end of the Cool Biz period, encouraging employees to set appropriate office air-conditioner temperatures and manage their physical comfort with clothing that matches the temperature.

At the Osaka and Tokyo Head Offices, we are working to reduce the carbon footprint of our facilities, primarily by introducing energy-saving air conditioners and fluorescent light fixtures, as well as a power consumption monitoring system that monitors peak electricity demand and intensifies power-saving measures if there is excess demand. Our fleet of company vehicles (25 vehicles as of FY2022) consists entirely of eco cars—namely, cars that are eligible for eco-car tax breaks.

When the Nagoya Branch relocated in 2015, we chose an environmentally friendly building with a CASBEE* S rank. For the reconstruction of the Tokyo Head Office announced in January 2022, we are considering high environmental performance and energy efficiency for the new building.

* CASBEE: The Institute for Built Environment and Carbon Neutral for SDGs’ comprehensive assessment system for building environmental efficiency that classifies buildings into five ranks of S, A, B+, B, and C.

We also focus on renewable energy, alternative fuels, low-carbon products, and other businesses that contribute to a decarbonized society.