- Basic Concepts

- Transitioning to a company with an audit and supervisory committee

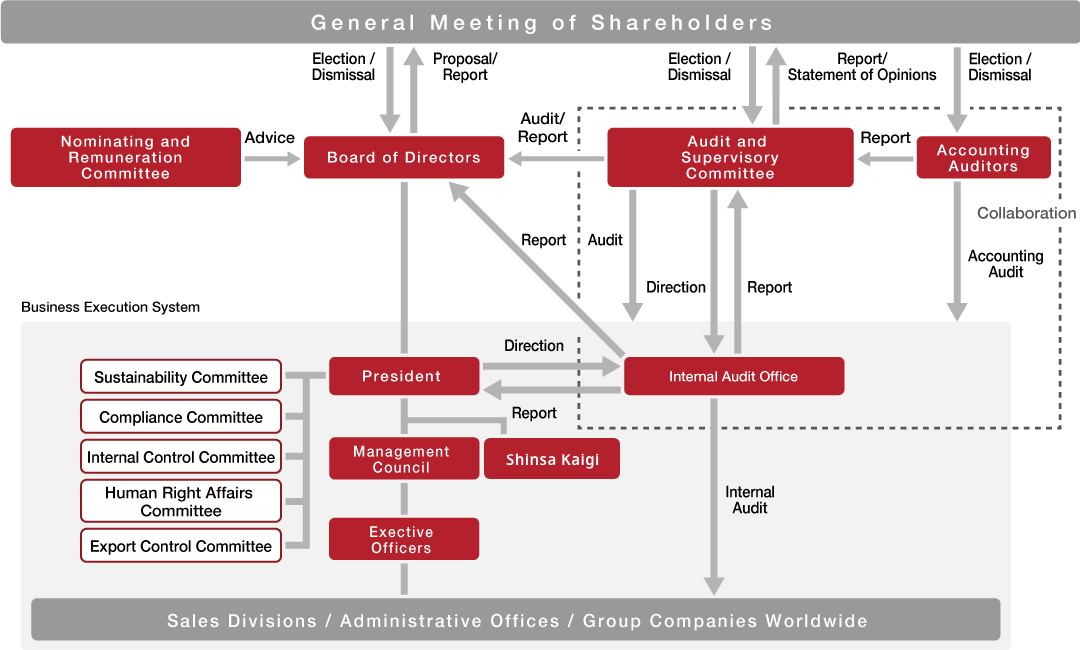

- Corporate governance system(chart)

- Corporate governance system

- Changes in initiatives to strengthen governance

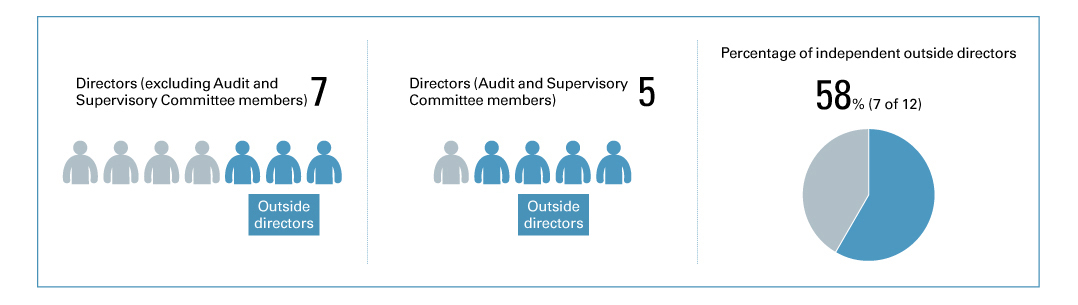

- Board of Directors

- Audit and Supervisory Committee

- Nominating and Remuneration Committee

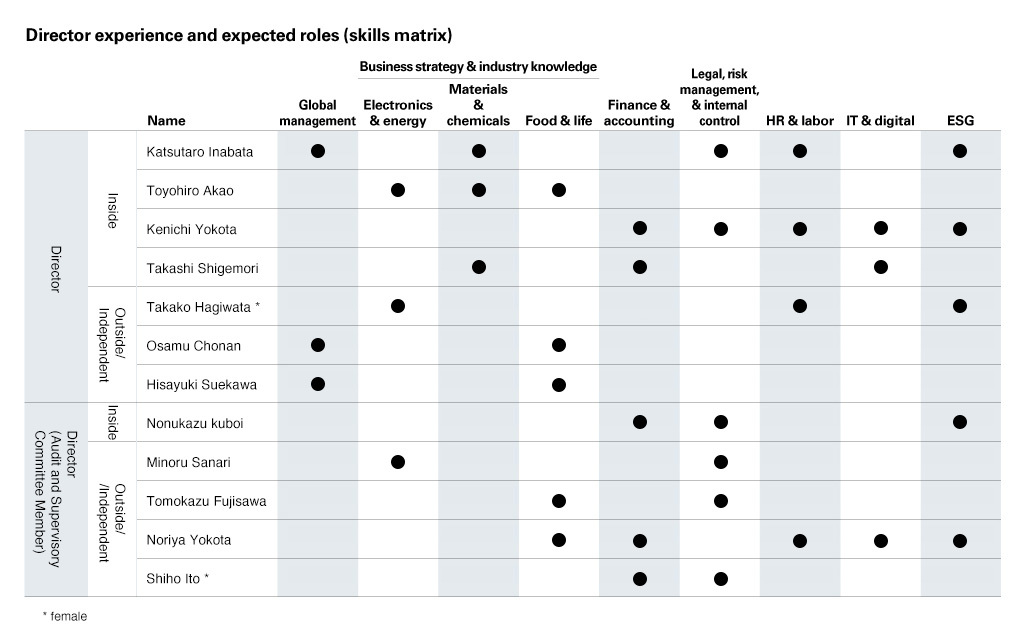

- Director experience and expected roles (skill matrix)

- Management

- Management Council and Shinsa Kaigi

- Audit system

- Structure for outside directors

- Training for outside directors

- The effectiveness evaluation of the Board of Directors

- Remuneration of directors and audit and supervisory committee members

- Strategically held shares

- Internal Control

Basic Concepts

The Inabata Group’s Mission is “People come first, based on the spirit of ‘love (ai )’ and ‘respect (kei ),’ and together we strive towards contributing to the development of society.” With a foundation on this mission, the Company aims to respond to the directive of all stakeholders who support the Company’s activities including shareholders, business partners, and employees, and sustainably improve corporate value. For this, the Company believes it is essential to have a strong corporate governance system for ensuring transparency and fairness in business and speed and resolution in decisions.

Company with an Audit and Supervisory Committee

We have positioned the enhancement and improvement of corporate governance as an important management issue, and have been working to improve the effectiveness of the Board of Directors by shifting the focus of meetings of the Board of Directors from business execution to management strategy and medium- to long-term issues. In June 2022, we transitioned to a company with an audit and supervisory committee in order to further promote these initiatives, further strengthen the Company’s supervisory function, and establish a system to accelerate management decision-making. The majority of the Board of Directors is composed of independent outside directors in order to embody a monitoring-type Board of Directors, thereby enhancing corporate value.

Corporate Governance System (As of December 15, 2023)

Corporate Governance System (As of December 15, 2023)

| Organizational design | Company with an audit and supervisory committee |

|---|---|

| Directors not on the Audit and Supervisory Committee | 7 (including 2 independent outside directors) |

| Directors on the Audit and Supervisory Committee | 5 (including 5 independent outside directors) |

| Chairperson of the Board of Directors | President |

| Term of office for directors not on the Audit and Supervisory Committee | 1 year |

| Term of office for directors on the Audit and Supervisory Committee | 2 years |

| Executive officer system | Yes |

| Advisory committees to the Board of Directors | Nominating and Remuneration Committee |

| Accounting auditors | KPMG Azsa LLC |

| Corporate Governance Report | Corporate Governance Report |

Changes in Initiatives to Strengthen Governance

Period

| June 2003 | Executive officer system introduced |

|---|---|

| June 2006 | Term of appointment of directors reduced from two years to one year |

| June 2013 | Appointment of two outside directors |

| June 2015 | Appointment of three outside directors |

| November 2015 | Nominating and Remuneration Committee (voluntary) established Evaluation of the Board of Directors introduced |

| June 2022 | Transition to a company with an audit and supervisory committee Transition to having outside directors comprise the majority of directors |

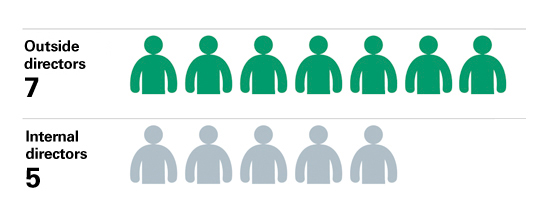

Board of Directors

The Board of Directors makes decisions on important matters set out in laws and regulations, Articles of Incorporation, and Regulations of the Board of Directors. These matters include formulation of business plans and annual budgeting as well as making basic management policies and appointing executive officers. The Board of Directors consists of 12 members, including seven directors who are not Audit and Supervisory Committee members and five directors who are Audit and Supervisory Committee members. Among the 12 members, seven are independent outside directors, comprising the majority. By shifting to a company with an audit and supervisory committee, we have transitioned to a monitoring-type Board of Directors with strengthened supervisory functions and made it possible to delegate important business decisions to business executives, establishing a system that enables us to make management decisions more quickly.

Audit and Supervisory Committee

Inabata is a company with an audit and supervisory committee, and the Audit and Supervisory Committee consists of five Audit and Supervisory Committee members, all of whom are outside directors. The committee audits the decision-making of the Board of Directors and the execution of duties by executive officers. Directors who are members of the Audit and Supervisory Committee are extremely well-versed in finance, accounting, and law, and are also highly independent.

In addition, the Audit and Supervisory Committee Office has been established as a dedicated organization to assist the Audit and Supervisory Committee in its duties, and suitable persons independent of the directors (excluding directors who are members of the Audit and Supervisory Committee) have been assigned to this office.

Nominating and Remuneration Committee

We voluntarily set up the Nominating and Remuneration Committee in 2015. The committee, the majority of which consists of independent outside directors and which is chaired by the lead independent outside director, engages in deliberations when making decisions on issues such as the selection and dismissal of executives, nomination of candidates for positions of director and executive officer, and the remuneration of directors. The Board of Directors strives to ensure objectivity, fairness, and transparency by fully respecting the deliberation results of the Nominating and Remuneration Committee.

Members of the Nominating and Remuneration Committee:

Three outside directors (of these, one director who is an Audit and Supervisory Committee member)

One internal director

Chairperson: Lead independent outside director

Number of times held: FY2022 10 times

Director Experience and Expected Roles (Skills Matrix)

Skills Matrix Approach

Our mission is that “People come first, based on the spirit of ‘love (ai )’ and ‘respect (kei )’, and together we strive towards contributing to the development of society,” and we seek to take the approach of “To continually evolve, serving clients and society, through global operations and meeting their changing needs.” We have also set forth our long-term vision, IK Vision 2030, which is how we envision ourselves around 2030, and have positioned our medium-term business plan, NC2023, as the second stage toward fulfilling that long-term vision. In identifying the skills expected of directors, we have determined what skills are necessary to build a system that can fulfill the decision-making and supervisory functions related to business execution of the Board of Directors of our globally operating company, based on our Mission, Vision, our long-term vision IK Vision 2030, and medium-term business plan, NC2023. From this perspective, we have specifically identified the skills listed on the right and developed a skills matrix.

Management Council and Shinsa Kaigi

We set up the Management Council as an institution for business execution. This council deliberates on basic policies and important matters related to management and decides their direction. We have also established the Shinsa Kaigi as an institution to review important matters related to business execution, investment and loan projects, and credit. Its participants (including those who join online) from across the world hold direct discussions with the management.

Number of times convened: FY2022

Management Council 13 times, Shinsa Kaigi 20 times

Audit System

Internal audits

We have established the Internal Audit Office and are working to strengthen its ranks in order to enhance internal audits. The office complies with the internal control reporting system related to financial reporting based on the Financial Instruments and Exchange Act, and also conducts internal audits as necessary from time to time. The Internal Audit Office reports regularly to the president, the Board of Directors, and the Audit and Supervisory Committee on audit plans and audit results.

Accounting auditors

Accounting audits, audits of financial statements, quarterly reviews, and internal control audits for Inabata are conducted by KPMG Azsa LLC. The Audit and Supervisory Committee formulates evaluation criteria, including autonomy, specialized knowledge, and assessment, for the appointment and suspension of accounting auditors, and makes decisions based on the evaluation results.

Cooperation among the Audit and Supervisory Committee, accounting auditors, and the Internal Audit Office

The Audit and Supervisory Committee, accounting auditors, and the Internal Audit Office collaborate through periodic reporting and discussion of audit results. In investigating the status of our operations and assets and performing other auditing duties, the Audit and Supervisory Committee works closely with the Internal Audit Office to ensure that audits are conducted in an organized and efficient manner.

In addition, the Audit and Supervisory Committee, accounting auditors, and the Internal Audit Office meet regularly to collaborate and share information.

Structure for Outside Directors

In electing outside directors, Inabata aims to appoint candidates who have abundant experience and knowledge of corporate management, the ability to oversee the decision-making and business execution of the Board of Directors of the Company which conducts business on a global basis, and who provide appropriate advice from an objective perspective. The proportion of outside directors stands at 58% (seven out of 12 directors).

Meetings of outside directors only

Number of times held: FY2022 2 times

Attendance status for FY2022

| Name | Autonomous | Years in office | Meetings of the Board of Directors | Nominating and Remuneration Committee | Reason for appointment |

|---|---|---|---|---|---|

| Directors not on the Audit and Supervisory Committee | |||||

| Takako Hagiwara (Leading independent outside director, Chairperson of the Nominating and Remuneration Committee) |

● | 2 years | 100% 16/16 times |

100% 10/10 times |

Takako Hagiwara served as representative director of Sony Hikari Corp. and Sony Kibou Corp., as well as a director of Green House Co., Ltd., and currently serves as representative director of DDD Corp. and outside director of Twinbird Corp. and NEC Capital Solutions Ltd. For many years she oversaw human resources in a major global electronics manufacturer with multiple businesses including audiovisual equipment, movies, and music, and has experience in management. Inabata appointed her in expectation of gaining advice on human resources strategies and diversity promotion. |

| Osamu Chonan (Nominating and Remuneration Committee member) |

● | Newly appointed | - | - | Osamu Chonan has served as representative director, president, and chief executive corporate officer of Kewpie Corp. He currently serves as chairman of the Kewpie Miraitamago Foundation. He held positions of responsibility for many years in the sales division of a food manufacturer with a global presence centered in China and Southeast Asia, in addition to which he has also served in management, and accordingly has extensive knowledge and experience. Based on this, Inabata considered him suitably qualified and appointed him as outside director. It is expected that he will use his abundant experience and extensive knowledge as a manager to provide oversight and advice in relation to the Company’s execution of business operations from an objective perspective. |

| Directors on the Audit and Supervisory Committee | |||||

| Kenji Hamashima (Nominating and Remuneration Committee member, Chairperson of the Audit and Supervisory Committee) |

● | 3 years | 100% 16/16 times |

100% 10/10 times |

Kenji Hamashima has served as director and senior executive vice president, and president and chief executive officer of Ushio Inc. He currently serves as special adviser of the same company and outside director of Nichirei Corp. As he possesses global and abundant experience and wide-ranging expertise as a member of the management of a manufacturer which produces applied optics products, such as industrial light sources, and industrial machinery, Inabata appointed him in expectation of accurate auditing and supervision of overall management. |

| Satoshi Tamai | ● | 1 year | 100% 13/13 times |

- | Satoshi Tamai serves as representative for the Satoshi Tamai Certified Public Accountant Office, and an outside auditor for Toho Lamac Co., Ltd. and PC Depot Corp. As he has experience working for a major trading company, has a CPA qualification, and has served as a representative partner for a major audit firm in Japan and an outside auditor for multiple companies, in addition to possessing knowledge as an accounting expert and wide-ranging expertise, Inabata appointed him in expectation of accurate auditing and supervision of overall management. |

| Minoru Sanari | ● | 1 year | 100% 13/13 times |

- | Minoru Sanari served as General Counsel, Legal Section, General Administration Department for Tokyo Gas Co., Ltd. before serving as an Executive Officer (in charge of governance), and is currently a Senior Advisor for said company. As he has expert knowledge and an abundance of experience from his involvement with corporate legal matters and corporate governance over the course of many years in his capacity as an attorney at the largest city gas company, Inabata appointed him in expectation of accurate auditing and supervision of overall management. |

| Tomokazu Fujisawa | ● | 1 year | 100% 13/13 times |

- | Tomokazu Fujisawa has served as full-time corporate auditor and director as a member of the audit & supervisory committee of Astellas Pharma Inc. He has worked as the Director of Planning for a business division in a global pharmaceutical company that develops pharmaceutical businesses around the world, also has experience in overseas subsidiaries and auditing operations, and has served as a director on the audit & supervisory committee, which is why Inabata appointed him in expectation of accurate auditing and supervision of overall management. |

| Noriya Yokota | ● | Newly appointed | - | - | Noriya Yokota has served as director and senior executive officer of Kirin Holdings Co., Ltd., director of Kirin Business System Co., Ltd., and director of Kirin Brewery Co., Ltd. He has served as a factory manager and head of the production department at a manufacturer that produces and sells alcoholic beverages, beverages, and pharmaceuticals around the world, and after serving as manager of an overseas subsidiary of the same company, he has been in charge of human resources, finance, IT, and management strategy as an executive officer. He accordingly has a great degree of insight and abundant experience. Based on this, Inabata has determined that he can be expected to provide accurate audit and supervision for the overall management of the Company and appointed him as outside director who is an Audit and Supervisory Committee member. |

- Notes: 1. Kenji Hamashima’s attendance at meetings of the Board of Directors includes the period in which he served as an independent outside director from April 1, 2022, to the closing of the 161st Ordinary General Meeting of Shareholders held on June 22, 2022.

Training for Outside Directors

In order to deepen outside directors’ understanding of the Group’s business activities, we provide opportunities for them to meet with the heads of each division, as well as opportunities to visit overseas (including online meetings) and conduct on-site inspections. Even after directors have assumed office, we offer and facilitate training opportunities to help them acquire the necessary knowledge and promote an understanding of their roles and responsibilities. The status of directors’ training is reported to the Board of Directors once a year.

The Effectiveness Evaluation of the Board of Directors

- Inabata has been conducting the effectiveness evaluation of the Board of Directors since FY2015.

- Each cycle lasts for three years in which self-evaluation is carried out for the first two years and third-party evaluation is carried out in the third year.

- The overview of the evaluation and issues to be considered are published on the Company’s website.

- Self-evaluation was carried out in FY2022.

Evaluation Results for FY2022

| Target of evaluation | All directors (11) in office as of the end of March 2023 |

|---|---|

| Summary of analysis and evaluation | As a result of analysis and evaluation, the operations of the Company’s Board of Directors have been generally appropriate and assessed highly, with open and active discussions. We also confirmed the following: (1) in general, the Company provides sufficient support to outside directors, who are thought of as making significant contributions to discussions at Board of Directors’ meetings; (2) the Nominating and Remuneration Committee is thought of as operating appropriately; (3) the Audit and Supervisory Committee is thought of as operating appropriately; (4) the status of dialogues with investors and shareholders is considered to be adequately provided to the Board of Directors; and (5) improvement efforts are believed to be made based on the results of Board of Directors evaluations, among other topics. It has been confirmed that the Board of Directors of the Company is generally functioning properly and that its effectiveness is secured. In addition, the following improvements and progress have been confirmed with regard to addressing the issues that were identified in the previous self-evaluation.

|

| Future course of action | Based on the results of this analysis and evaluation, we will strive to further enhance the effectiveness of the Board of Directors by addressing the issues identified. In FY2023, an effectiveness evaluation (third-party evaluation) is scheduled to be implemented. |

Questions

- 1. Operational status of the Board of Directors

- 2. Function and role of the Board of Directors

- 3. Composition of the Board of Directors

- 4. Composition and role of the Nominating and Remuneration Committee

- 5. Operational status of the Nominating and Remuneration Committee

- 6. Composition and role of the Audit and Supervisory Committee

- 7. Operational status of the Audit and Supervisory Committee

- 8. Support system for outside directors

- 9. Relationship with investors and shareholders

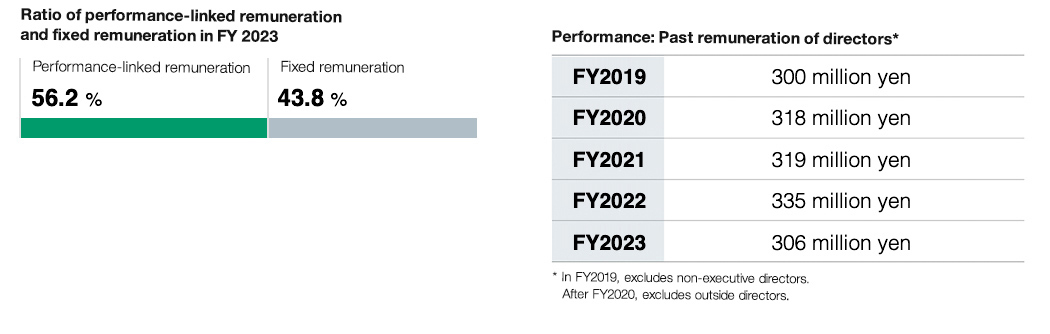

Remuneration of Directors and Audit and Supervisory Committee Members

A summary of information on remuneration and other benefits is as follows.

1. Remuneration for directors who are not Audit and Supervisory Committee members

| (1) Fixed remuneration*1 | Minimum guaranteed amount by position |

|---|---|

| (2) Performance-linked remuneration | Calculated by multiplying the fixed remuneration for each position in (1) by a coefficient for: ・Profit before income taxes and non-controlling interests (excluding gain on sales of certain strategically held shares)*2 ・Returns on capital (ROIC and ROE)*3 ・Stock price*3 ・ Each level of ESG scores from multiple external evaluation organizations (FTSE Russell and MSCI)*4 |

| (3) Board Benefit Trust (BBT)*5 | A system under which executive directors receive the points granted to them during their term in the form of shares and cash upon their retirement. The calculation method of points granted to directors is as follows. (Method of calculating points awarded to directors) Points granted for the current year = ⒶService points + ⒷPerformance points Ⓐ50% of the base points determined for each position (fixed) ⒷService points × performance coefficient Performance coefficient: Coefficient determined by the achievement rate for consolidated sales targets and consolidated operating profit targets Target achievement rate: Actual performance compared to the rate externally announced in the medium-term business plan |

- *1:Remuneration for directors who are not executive directors is fixed remuneration only.

- *2:Executive directors are responsible for all business activities of the entire Group, including the operating and financial activities of Group companies, and we believe that the results of these activities are reflected in consolidated profit before income taxes and non-controlling interests, which is used as one indicator.

- *3:We have adopted ROIC as an indicator because one of the key initiatives in our medium-term business plan, NC2023, is “intensification of investment targeting future growth,” and we believe that capital efficiency and investment yield should also be considered in light of requests from the capital market and trends among listed companies. In addition, as part of our measures to realize management conscious of cost of capital and share prices, we are using ROE and share price (specifically, the difference between the year-on-year growth rate of TOPIX and the year-on-year growth rate of our share price) as new indicators.

- *4:Since we recognize that addressing sustainability is an important management issue for our company, we obtain ESG scores from several external evaluation organizations and use them as an indicator.

- *5:We have introduced the Board Benefit Trust (BBT) as a performance-linked stock compensation plan in order to clarify the linkage between the compensation of executive directors and our business performance and stock value. Having directors share not just the benefits of higher stock prices, but also the risk of lower stock prices with shareholders, will increase their awareness, so that they can contribute to improving business performance and increasing corporate value over the medium to long term.

Of the remuneration for directors who are not members of the Audit and Supervisory Committee, (1) fixed remuneration and (2) performance-linked remuneration are determined by the Board of Directors within the scope of the total amount of remuneration approved by the Ordinary General Meeting of Shareholders. The maximum amount of remuneration for directors who are not members of the Audit and Supervisory Committee as per the resolution of the Ordinary General Meeting of Shareholders is 430 million yen per year (of which 50 million yen is for outside directors). In addition, as a performance-linked stock compensation plan for executive directors, the Company has resolved (3)compensation limits for the Board Benefit Trust (BBT).

The individual remuneration of directors who are not Audit and Supervisory Committee members is designed to be calculated automatically using a formula and coefficient defined in regulations resolved by the Board of Directors, without taking qualitative factors into consideration, and the Human Resources Office will calculate this in accordance with regulations. The results of the calculations are reviewed by the Nominating and Remuneration Committee, which is chaired by the lead independent outside director and at which independent outside directors have a majority. The Board of Directors determines the compensation of directors who are not Audit and Supervisory Committee members with full respect for the results of the deliberations of the Nominating and Remuneration Committee.

These sorts of procedures ensure objectivity, fairness, and transparency in the determination of individual compensation for directors who are not Audit and Supervisory Committee members, and the determination of individual compensation is never delegated to specific directors or other parties.

2.Remuneration for directors who are Audit and Supervisory Committee members

| Fixed remuneration | Fixed remuneration only |

|---|

Remuneration for directors who are Audit and Supervisory Committee members is decided via discussions by directors who are Audit and Supervisory Committee members, within the scope of total remuneration approved by the Ordinary General Meeting of Shareholders. The maximum remuneration amount for directors who are Audit and Supervisory Committee members, as per the resolution of the Ordinary General Meeting of Shareholders, is 80 million yen per year.

Actual remuneration of directors in FY2022*6,*10

| Classification | Total amount of remuneration and other benefits (millions of yen) | Total amount of remuneration and other benefits by type (millions of yen) | No. of eligible persons | ||

|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration | Board Benefit Trust (BBT) | |||

| Directors (excluding Audit and Supervisory Committee members and outside directors)*7,*11,*12,*13 | 335 | 140 | 128 | 67 | 6 |

| Directors (Audit and Supervisory Committee members; excluding outside directors)*8 | - | - | - | - | - |

| Audit & Supervisory Board members (excluding outside Audit & Supervisory Board members)*9 | 6 | 6 | - | - | 1 |

| Outside directors and auditors | 58 | 58 | - | - | 10 |

- *6:The above includes one director, one outside director, one internal Audit & Supervisory Board member, and three outside Audit & Supervisory Board members who retired at the conclusion of the 161st Ordinary General Meeting of Shareholders held on June 22, 2022. On June 22, 2022, we transitioned from a company with an audit & supervisory board to a company with an audit and supervisory committee.

- *7:Remuneration and other benefits for directors (excluding Audit and Supervisory Committee members) before and after the transition to the company with an audit and supervisory committee system is as follows.

After the transition to a company with an audit and supervisory committee

At the 161st Ordinary General Meeting of Shareholders held on June 22, 2022, the annual amount of remuneration for directors (excluding Audit and Supervisory Committee members) was approved at up to 430 million yen (of which 50 million yen is for outside directors). In addition, at the same General Meeting of Shareholders, remuneration limits for the Board Benefit Trust (BBT), the introduction of which was approved at the 157th Ordinary General Meeting of Shareholders held on June 22, 2018, were reapproved.

Before the transition to a company with an audit and supervisory committee

At the 145th Ordinary General Meeting of Shareholders held on June 29, 2006, the annual amount of remuneration for directors was approved at up to 430 million yen. Separate to the above remuneration limit, at the 157th Ordinary General Meeting of Shareholders held on June 22, 2018, the introduction of a BBT as a performance-linked stock compensation plan for directors (excluding outside directors) was approved. - *8:At the 161st Ordinary General Meeting of Shareholders held on June 22, 2022, the annual amount of remuneration for directors (Audit and Supervisory Committee members) was approved at up to 80 million yen.

- *9:The remuneration amount for Audit & Supervisory Board members is the amount received while in office by four Audit & Supervisory Board members who retired at the conclusion of the 161st Ordinary General Meeting of Shareholders held on June 22, 2022. Of the four members, one was newly appointed as a director (Audit and Supervisory Committee member) after retiring as an Audit & Supervisory Board member at the conclusion of the said meeting. Consequently, the stated amounts paid and number of persons paid includes their term of office as an Audit & Supervisory Board member in the “Audit & Supervisory Board members” row and their term of office as an Audit and Supervisory Committee member in the “Directors (Audit and Supervisory Committee members)” row. Furthermore, at the 145th Ordinary General Meeting of Shareholders held on June 29, 2006, the annual amount of remuneration for Audit & Supervisory Board members was approved at up to 80 million yen.

- *10:The number of persons paid shows the cumulative total; however, the actual number of persons eligible for payment is 15 (of which eight are outside directors/auditors).

- *11:BBT is the amount of provision for the reserve for directors’ stock benefits included in the fiscal year under review.

- *12:The Company has not established a guideline on deciding the payment ratio between performance-linked remuneration and other types of remuneration for directors (excluding directors who are Audit and Supervisory Committee members and outside directors) because these forms of remuneration are determined automatically based on their respective performance indicators and formulas, and therefore have no possibility of being adjusted arbitrarily.

- *13:Remuneration for directors for the fiscal year under review was deliberated on at a meeting of the Nominating and Remuneration Committee held on May 23, 2022, and approved at a meeting of the Board of Directors held on June 22, 2022. The Board of Directors has checked that the determination method for, and the details of, the individual remuneration for directors in the fiscal year under review are consistent with the determination policy approved by the Board of Directors, and has deemed that they are in accordance with such determination policy.

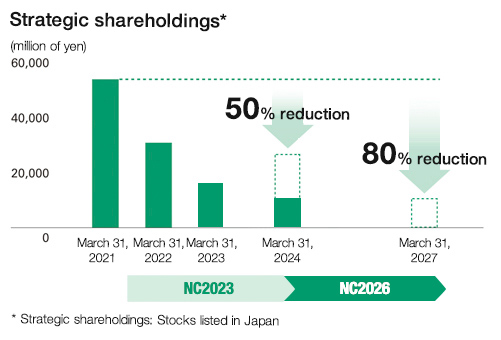

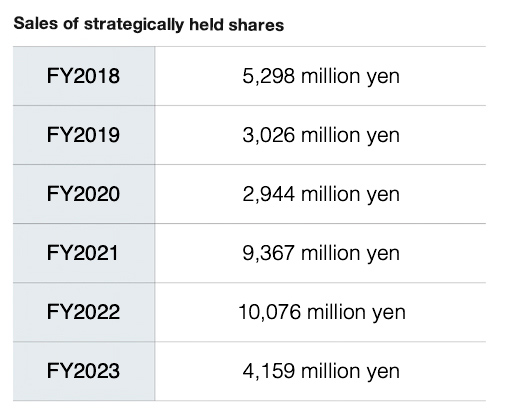

Strategically held Shares

Basic views

Close business and cooperative relations with various companies are valuable assets to Inabata, and the Company believes the establishment, maintenance and development of these relations improve the Company’s corporate value in the medium and long term and lead to the benefit of shareholders and investors. Also, as Inabata believes that strategically holding shares of such companies continues to be an effective way to establish, maintain, and develop good cooperative relations, the Company owns strategically held shares.

Policy related to holding and reducing strategically held shares

Inabata forms a judgment concerning the pros and cons of strategically held shares based on whether holding them contributes to the establishment of cooperative relations, enhances the Company’s corporate value in the medium and long term, and leads to the benefit of shareholders and investors. To be specific, the Board of Directors will make annual comprehensive reviews of the appropriateness of holding each individual stock, taking into account the financial condition of the investee company, the liquidity of the stock, trends in the volume of transactions and profits related to business with the Company or its Group companies and their medium- to long-term prospects, economic rationales such as whether the risk and return are commensurate with the cost of capital, and other qualitative information. The Company follows a policy of reducing the shares that the holding of which is not considered significant, while considering timing and the effect on the market and the business.

Note that we have set “continuous review of assets and further improvement of capital and asset efficiency” as a key initiative in our three-year medium-term business plan, NC2023, which ends in FY2023. Specifically, the policy is to reduce the balance of strategically held shares by 50% over the three-year period during the promotion of NC2023, relative to the balance as of March 31, 2021. We will also reduce strategically held shares over the medium to long term, aiming to reduce the balance by approximately 80% by March 31, 2027, relative to the balance as of March 31, 2021. Based on this policy, we will further reduce our strategically held shares by more rigorously verifying the significance of our holdings.

Criteria for exercise of voting rights

In principle, Inabata exercises voting rights for all agendas in order to exercise its rights as a shareholder. The Company reviews the merits and demerits of each agenda and exercises voting rights based on the judgment criteria of whether sustainable growth of the held company and improvement of its corporate value in the medium and long term can be expected.

Internal Control

Policy and system

Inabata maintains and operates an internal control system to support compliance and ensure proper business operations. The system was created in accordance with our basic policy on the internal control system and the progress of system development, which is based on the Companies Act and the Ordinance for Enforcement of the Companies Act. We also maintain basic regulations for internal control related to financial reporting, based on the Financial Instruments and Exchange Act, stipulating our basic policy and system, roles and responsibilities, and guidelines for evaluation of our financial reporting. Results of the evaluations of the effectiveness of our internal control system are reported in the Internal Control System Report, which receives an internal control audit by an independent auditor and is submitted with our annual securities report.

The internal control system includes the Internal Control Committee and Compliance Committee, which are respectively chaired by the individuals in charge of the internal control and compliance, as well as offices including the Risk Management Office and Business Process Management Office. The committees and offices work together to ensure effective operations among subsidiaries and throughout the Inabata Group.

The Internal Audit Office, which is independent of the executive bodies of the business divisions, supplements business audits conducted by the audit & supervisory committee and accounting audits by the independent auditor by carrying out internal audits (business audits) to ensure sound and appropriate business operations of the Group. Inabata is enhancing Group governance by conducting internal audits that include its subsidiaries.