Last Update August 28, 2024

Profile

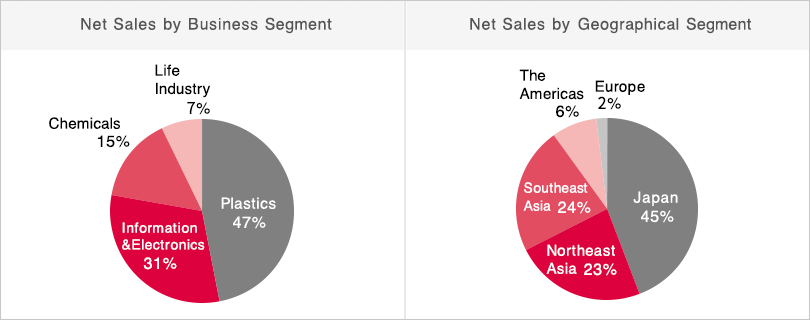

Inabata & Co., Ltd. is a specialized trading company operating in four business segments led by Information & Electronics and Plastics, followed by Chemicals and Life Industry. Inabata operates at 70 locations across 19 countries outside Japan. Inabata is capable of responding to diverse and global needs of its clients, utilizing its highly specialized expertise in each business segment, offering a comprehensive service ranging from planning, logistics, and manufacturing/processing. Inabata operates multiple manufacturing/processing bases mainly in Asia. Close collaboration with clients gives Inabata access to the latest information on product developments and marketing trends. This is what makes Inabata’s strategy to expand its trading business unique.

Share information

(millions)

(FY03/24)

Inabata’s Strengths

■History, customer base, and human capital

- History and customer base:Founded in 1890. Over 130+ years of history, we have built a solid customer base consisting of about 10,000 companies.

- Customer-centric sales approach:As a trading company specializing in chemical products, we possess a high level of expertise and a global information network, enabling us to promptly and meticulously respond to customers’ global expansion needs.

- Value-added services:We have differentiated ourselves from competitors by providing value-added services, including small-lot production of multiple products and vendor managed inventory functions.

■Robust business foundation in Asia

- Of our 70 business locations across 19 countries globally, 56 are in 11 Asian countries, excluding Japan, and we have allocated about 3,000 personnel, equivalent to 64% of the consolidated workforce, to these locations.

- Southeast Asia:Expanded the Plastics business, with the compound business, which boasts industry-leading production capacity, as the driving force of differentiation.

- Northeast Asia:Grew the Information & Electronics business, by steadily expanding the customer base and product lines handled, centered primarily on flat panel display materials.

Investment Highlights

Net sales and operating profit hit record highs for three consecutive years

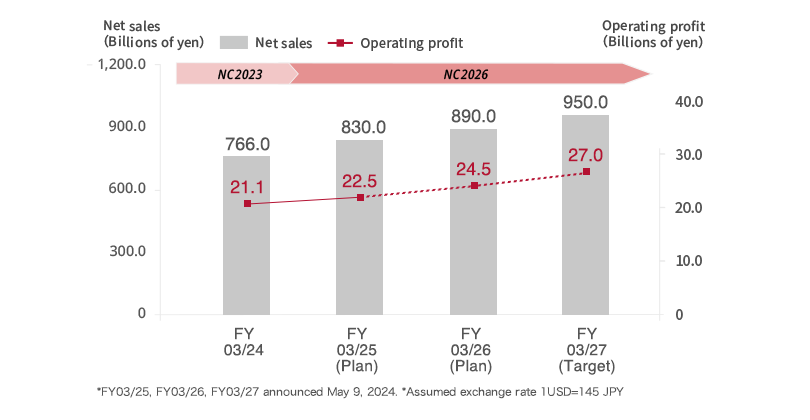

Under the previous medium-term management plan NC2023, we substantially grew our earnings. In FY03/24, due in part to contributions from newly consolidated subsidiaries through M&A and the weak yen, net sales amounted to ¥766.0 billion and operating profit to ¥22.5 billion, renewing their respective previous record highs for the third consecutive year. In the long-term vision dubbed IK Vision 2030, we target net sales of ¥1,000 billion.

※FY03/21(actual):Net sales ¥577.5 billion, operating profit ¥14.9 billion

New Mid-Term Management Plan

■New medium-term management plan, New Challenge 2026, has started

The main theme of the plan is to accelerate growth through aggressive investment, including in M&A. We intend to allocate management resources mainly to environment-related (renewable energy, recycling), automobile-related (NEVs and batteries), and food-related fields. For FY03/27, the final year of the plan, we target net sales of ¥950.0 billion and operating profit of ¥27.0 billion.

■Basic Policy on Shareholder Return during NC2026

- 1) Progressive dividends

- 2) Target total return ratio of around 50%

- * Dividend Per Share in FY03/25 (forecast)

Annual dividend ¥125 : interim ¥60, year-end ¥65