Mid-term Management Plan

New Challenge 2026 (NC2026)

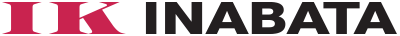

Toward Achieving Long-term IK Vision 2030

Inabata Group is promoting the "New Challenge 2026" mid-term management plan for the next three years, which is the third stage towards achieving our long-term vision "IK Vision 2030" by around 2030.

Long-term Vision: IK Vision 2030

What Inabata envisions to be in years around 2030

| Consolidated sales | Achieving more than 1 trillion JPY in consolidated sales in early stage. |

|---|---|

| Enhance multifaceted capabilities | Further enhancing multi-faceted capabilities such as manufacturing, logistics and finance, in addition to trading. |

| Business portfolio | At least 1/3 of business from segments other than Information & Electronics and Plastics. |

| Overseas ratio | 70% or more |

【Formulated May 2017】

Mid-term Management Plan: NC2026

Three-year mid-term management plan, the third stage toward achieving our long-term vision

Please visit the PDF below for details on Mid-term Management Plan NC2026.

NC2026 Overview

Quantitative Targets

(Fiscal Year Ending March 2027)

| Net Sales | 950.0billion JPY |

|---|---|

| Operating Profit | 27.0billion JPY |

| Ordinary Profit | 26.0billion JPY |

| Profit attributable to owners of parent | 19.0billion JPY |

| ROE | 10% or more |

|---|---|

| Net D/E ratio | 0.5 X or less |

| Equity ratio | Approximately 50% |

※Assumed exchange rate 1USD=145 JPY

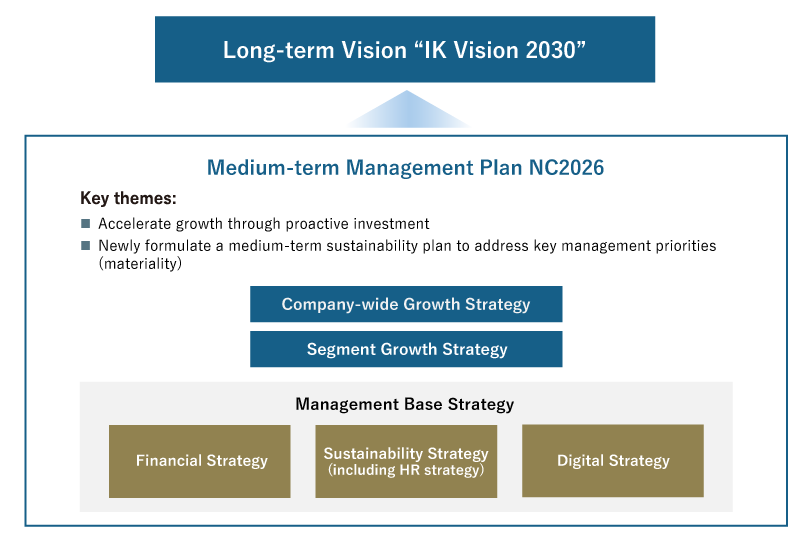

Capital Allocation

1. Capital Allocation

The three-year capital allocation plan during the period of NC2026 is as below.

2. Basic Policy on Shareholder Return

During NC2026,

- 1) The actual amount of dividends paid in the previous fiscal year will be used as the lower limit for dividends per share, and the basic policy is to continuously increase the dividends without reducing them (Progressive dividends).

- 2) The target for total return ratio is roughly 50%.

3. Strategic shareholdings reduction policy

Further reduce strategic shareholdings in the medium to long term, cutting the balance of strategic shareholdings at the end of March 2021 by about 80% by the end of March 2027.

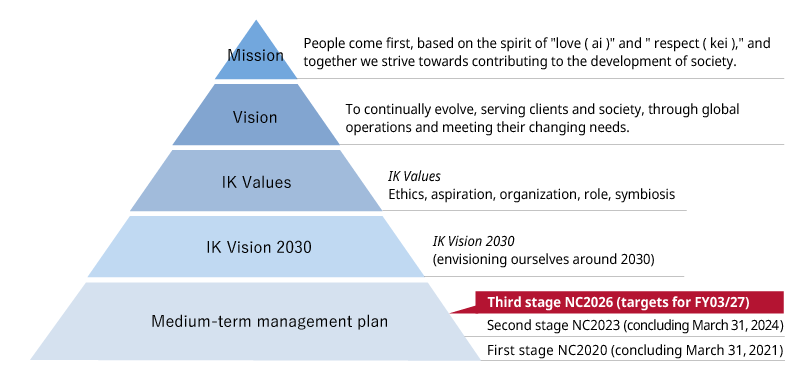

NC2026 Key Strategy

Company-wide Growth Strategy

| Long-term vision | Strategy |

|---|---|

| Consolidated sales Over ¥1 trillion |

|

| Enhance multifaceted capabilities |

|

| Business portfolio |

|

| Overseas ratio 70% or more |

|

Management Base Strategy

| Management base | Strategy |

|---|---|

| Financial |

|

| Sustainability |

|

| Digital strategy |

|

Financial Results and Quantitative Targets