Message from the President

Valuing communication

President’s roundtable and a new corporate message

In April 2024, we launched New Challenge 2026 (NC2026), the third stage of our medium-term management plan aimed at realizing our long-term vision, IK Vision 2030. To successfully execute the plan, we recognized the importance of open communication between management and employees, and put into action a long-prepared initiative: roundtable discussions with the president. Between July 2024 and February 2025, we held a total of 15 roundtable discussions, each focused on a specific theme such as career planning, human resource development, corporate culture, investment strategies, and the current and ideal functions of a shosha, or Japanese trading company. Employees interested in each topic were invited to participate. Rather than simply delivering my own message, I focused on listening carefully to employees. Through this process, I realized that things I had assumed were well understood often were not, and I also became aware of many of my own assumptions. It proved to be a highly valuable experience. We intend to address the many action items raised during the roundtable discussions through various initiatives moving forward.

Building on some of the themes from the recent roundtable discussions, we have launched the MOVE MOVE Project to develop our corporate message. The project name embodies the idea of employees taking initiative to drive Inabata’s future forward. Project members, primarily young leaders from various workplaces, are actively engaged in workshops and related discussions. I look forward to seeing how they will articulate the Company’s vision beyond the long-term vision in their own words.

President’s roundtable: Shaping Inabata’s future Conversing with the president

From July 2024, we held 15 president’s roundtable sessions, with a total of 132 employees taking part. Employees from a wide range of departments, positions, and age groups engaged in open and lively exchanges of ideas. Many also took part in the informal gatherings held afterward, which further deepened connections.

Implementation period

Term 1: July–October 2024 (8 sessions)

Term 2: November 2024–February 2025 (7 sessions)

Number of participants

Total of 132 (including those who attended multiple sessions)

Themes of the discussions

- The current and future functions of the Company

- Investment strategies

- Building career plans at the Company (Part 1: Systems related to retirement age extension)

- Building career plans at the Company (Part 2: Assignments and transfers)

- Human resource development

- Diversity and inclusion (D&I)

- What should change and what should be preserved (organizational culture)

Review of FY2024

Achieved record highs in net sales, operating profit, and ordinary profit

In FY2024, we achieved record highs in net sales, operating profit, and ordinary profit, marking a strong start to the first year of our medium-term management plan, NC2026. The weak yen provided a tailwind, but it was particularly our two key segments, Plastics and Information & Electronics, that significantly outperformed plans and drove overall growth.

In the Plastics segment, demand related to office automation (OA) equipment recovered significantly, mainly in Southeast Asia. This led to not only increased sales at our trading bases but also higher operating rates at our compounding factories, resulting in substantial profit growth. Additionally, the joint venture Novacel Co., Ltd., established with Daicel Corporation and newly consolidated, got off to a strong start and also contributed to our financial performance.

In the Information & Electronics segment, the recovery in OA-related demand provided a tailwind, and the market for flat panel displays (FPDs) remained strong, supported by economic stimulus measures in China.

On the other hand, our efforts in key focus areas such as materials for storage batteries and solar power generation have faced delays due to the rapid slowdown in the EV transition and worsening market conditions. Nevertheless, we believe that the long-term social demand to address environmental and energy challenges remains unchanged, and remain committed to advancing these initiatives.

Progress toward IK Vision 2030

Continuing to accelerate efforts toward achieving the four goals

It is still a bit early to determine whether we will achieve the four goals set out in IK Vision 2030, but I would like to share our current progress.

As for our goal of achieving consolidated net sales of one trillion yen or more, we aim to reach this during the next medium-term management plan, which will mark the final phase of IK Vision 2030. However, we expect to gain a clear outlook toward this target during the NC2026 period.

Regarding the goal of further advancing multifaceted capabilities, in addition to our existing functions, including manufacturing, processing, logistics, and trading (trading company functions), we are also considering adding entirely new capabilities such as research and development. Our aim is to continue expanding the value we offer. In addition, to further enhance our manufacturing and processing functions, we are strengthening our organizational structure by establishing the Manufacturing Site Support Department within the Financial Management Office.

Progress has been limited toward our goal of generating at least one-third of sales and operating profit from business segments other than Information & Electronics and Plastics. That said, the intent behind this policy is to avoid overdependence on any specific business domain. In that respect, even within our two main segments, Information & Electronics and Plastics, new business domains have been emerging, and the nature of these segments is gradually evolving. Of course, we will not rest on these developments. We remain committed to accelerating growth in the Chemicals and Life Industry segments through proactive investments and other strategic initiatives.

Regarding the goal of achieving an overseas ratio of 70% or more, the domestic ratio has actually increased over the past two years due to the high domestic sales proportion of newly consolidated subsidiaries. This policy emphasizes that achieving one trillion yen in sales will naturally result in an overseas sales ratio of around 70%. At that point, it will be crucial for the entire Group to establish an appropriate governance structure. Accordingly, strengthening governance frameworks to match the Group’s expanding consolidated scope, both domestically and internationally, remains an ongoing challenge. We are steadily expanding our overseas business, with a more detailed discussion on structural enhancements to follow. Anticipating strong growth ahead, we opened our fifth office in India, the Bangalore Office, in July 2024, and established a new branch in Cambodia under Inabata Thai Co., Ltd. in April 2025.

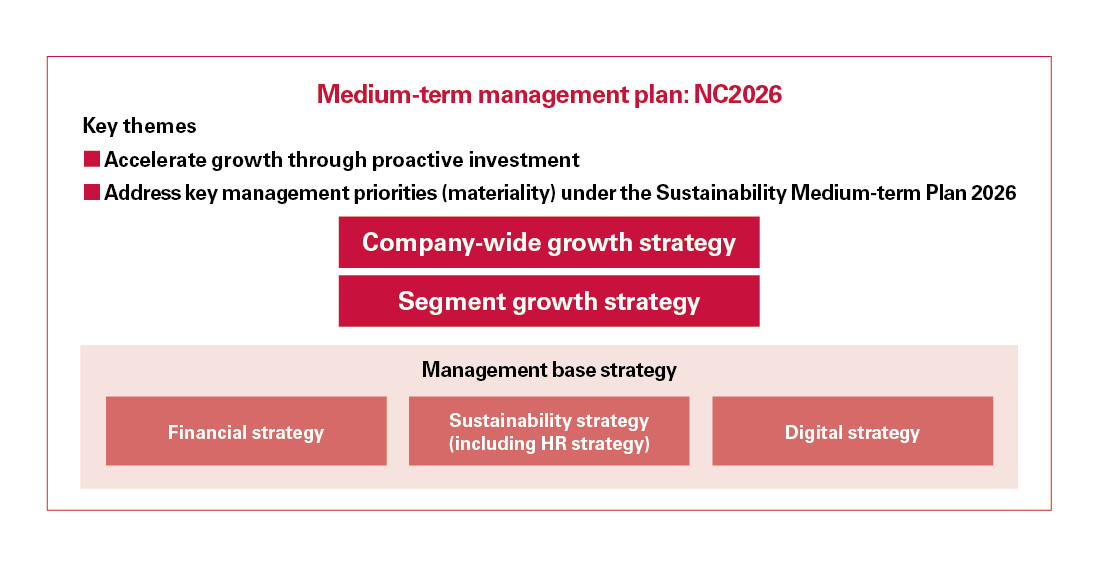

Initiatives under NC2026

Aiming to realize our growth strategy by focusing on proactive investment and sustainability management

As the second year of NC2026, FY2025 will be a year of steadily taking steps toward the realization of IK Vision 2030 while adapting to ongoing changes in the world around us. This fiscal year, we remain committed to steadily and actively advancing the key initiatives outlined in our management plan: proactive investment and addressing key management materiality through our Sustainability Medium-term Plan. The individual strategies are as follows.

Growth strategy

NC2026 focuses on organic growth as its foundation, while aiming to accelerate expansion through proactive investment. Since establishing the Business Planning Office in July 2021 to identify and screen investment opportunities, we have reviewed numerous projects. One notable outcome is the formation of Novacel Co., Ltd., a joint venture with Daicel Corporation, as mentioned earlier. While the joint venture has gotten off to a smooth start, the real challenge of realizing full synergies lies ahead. Not limited to Novacel, we believe that enhancing our capability to drive post-merger integration (PMI) in both completed and upcoming projects is essential for the successful execution of investment initiatives. To strengthen our organizational structure, we established a department dedicated to promoting PMI within the Business Planning Office in August 2024. We are working to strengthen governance by collaborating with corporate departments such as the Internal Audit Office and the Financial Management Office, while also partnering with sales divisions to drive the realization of synergies.

Financial strategy

We will continue to control our cost of capital to maintain return on equity (ROE) levels. We also believe it is important to steadily execute our growth strategy, continuously enhance business value, and foster growth expectations.

In response to rising interest rates resulting from recent global economic changes, we have been gradually strengthening the capital of our overseas offices over the past two to three years. Thanks to these efforts, the impact of rising interest rates on non-operating income and expenses for the consolidated Group has been kept lower than initially expected. We will continue to implement a flexible financial strategy to address rising interest rates going forward.

Sustainability strategy

In May 2024, we announced our medium-term management plan, NC2026, alongside the release of the Sustainability Medium-term Plan 2026. We have identified key risks, opportunities, and major initiatives related to materiality, and established a long-term vision, strategies, key performance indicators (KPIs), and targets. We encourage you to review them at your convenience. In July 2024, we concluded our first-ever green loan, and in November, we decided to issue our first green bonds. Both are important new milestones for the Company.

Please refer to Progress of the Sustainability Medium-term Plan 2026 on page 31.

Utilization of human capital

Human capital utilization is recognized as a critical material issue in our Sustainability Medium-term Plan and forms the foundation for business continuity. To address this, we have set a range of KPIs. We expanded the employee engagement survey to include our domestic manufacturing facilities, resulting in a significant improvement in response rates. However, the proportion of positive responses declined. We will carefully analyze the underlying causes and address them sincerely. We have made steady progress on KPIs related to D&I. We are developing a human resource database to support the promotion of local staff to executive positions at overseas subsidiaries and plan to accelerate these efforts.

With the staff of Inabata Industry & Trade (Dalian F.T.Z.)

Digital strategy (leveraging DX)

Our digital strategy centers on three key areas: the strategic use of information across the entire Group, corresponding improvements in security levels, and boosting productivity through digital transformation (DX) initiatives. Specifically, the most critical issue is the renewal of our core system, and the project is progressing smoothly. With the ongoing expansion of our Group-wide network, maintaining consistent security standards across our headquarters and both domestic and international subsidiaries is essential. We are committed to continuously strengthening these standards through regular audits and ongoing guidance. In terms of DX, we are adopting tools to streamline operations while also working to maximize the use of our information assets—for example, by leveraging generative AI to analyze daily sales reports.

To our stakeholders

Navigating shifting currents with the agility that defines a trading company

Since the launch of the second Trump administration in January 2025, there has been growing commentary that the world has entered an era of division, with some even describing the situation as a crisis of free trade. This could be seen as a challenging time for trading companies, which have grown in tandem with the expansion of free trade. However, from a different perspective, the social momentum toward sustainable capitalism, which accelerated rapidly during the COVID-19 pandemic, and the direction of the second Trump administration, while seemingly at odds, may not be entirely unrelated. It may take a little more time to clearly understand the major trends. Inabata is committed to navigating any shifts in the environment with the flexible approach characteristic of a shosha, or Japanese trading company. Each of our employees is expected to see these changes not as limitations but as opportunities for growth and to transform them into chances for success. We will continue to listen to the opinions of our stakeholders and work toward our sustainable growth. We appreciate your continued support and look forward to your ongoing cooperation.