CFO Interview

Achieved record-high profits for four years in a row Accelerating growth through proactive investment

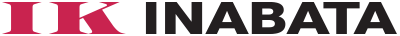

In FY2024, the first year of our medium-term management plan, NC2026, our key business segments performed better than expected, prompting us to revise our earnings forecast mid-year. We met our targets for both net sales and all profit metrics relative to the initial plan for the first year. Net sales reached 837.8 billion yen and operating profit totaled 25.8 billion yen, both marking record highs for the fourth consecutive fiscal year.

Regarding the business environment and performance by segment, the Information & Electronics segment has reached peak demand in its formerly core flat panel display (FPD)-related business. Materials related to semiconductors and electronic devices have become a new growth pillar to offset this. With an eye on the expanding AI market, we are working to enhance our product lineup. Products for the environment and energy sectors represent another core pillar. While growth has not yet shown a steady upward trend due to recent changes in U.S. policies, there is substantial long-term potential as opportunities expand in renewable energy, energy-saving products, and low-carbon materials.

In the Chemicals segment, sales of automobile component materials declined due to a slowdown in EV sales, while sales of resin materials, additives, and chemicals for papermaking remained steady. Sales to overseas markets are also expanding. In this segment, two companies from the Maruishi Chemical Group, which became subsidiaries in 2023, are contributing to earnings.

While the Life Industry segment is expected to grow, both the life sciences and food-related areas saw flat top-line performance. In the food-related sector, domestic sales of frozen vegetables and marine products for conveyor-belt sushi restaurants remained steady, as did performance from Daigo Tsusho Co., Ltd., which became a consolidated subsidiary in the previous fiscal year. At the same time, sales of marine products and other Japanese food items in the U.S. market declined, resulting in weaker profitability.

Meanwhile, the Plastics segment performed steadily. It was a year of growth, particularly for high-performance resins and related materials used in home appliances and office automation (OA) equipment, and for resins in food containers. The consolidation of Novacel Co., Ltd., a joint venture with Daicel Corporation, as a subsidiary also contributed to the segment’s improved performance.

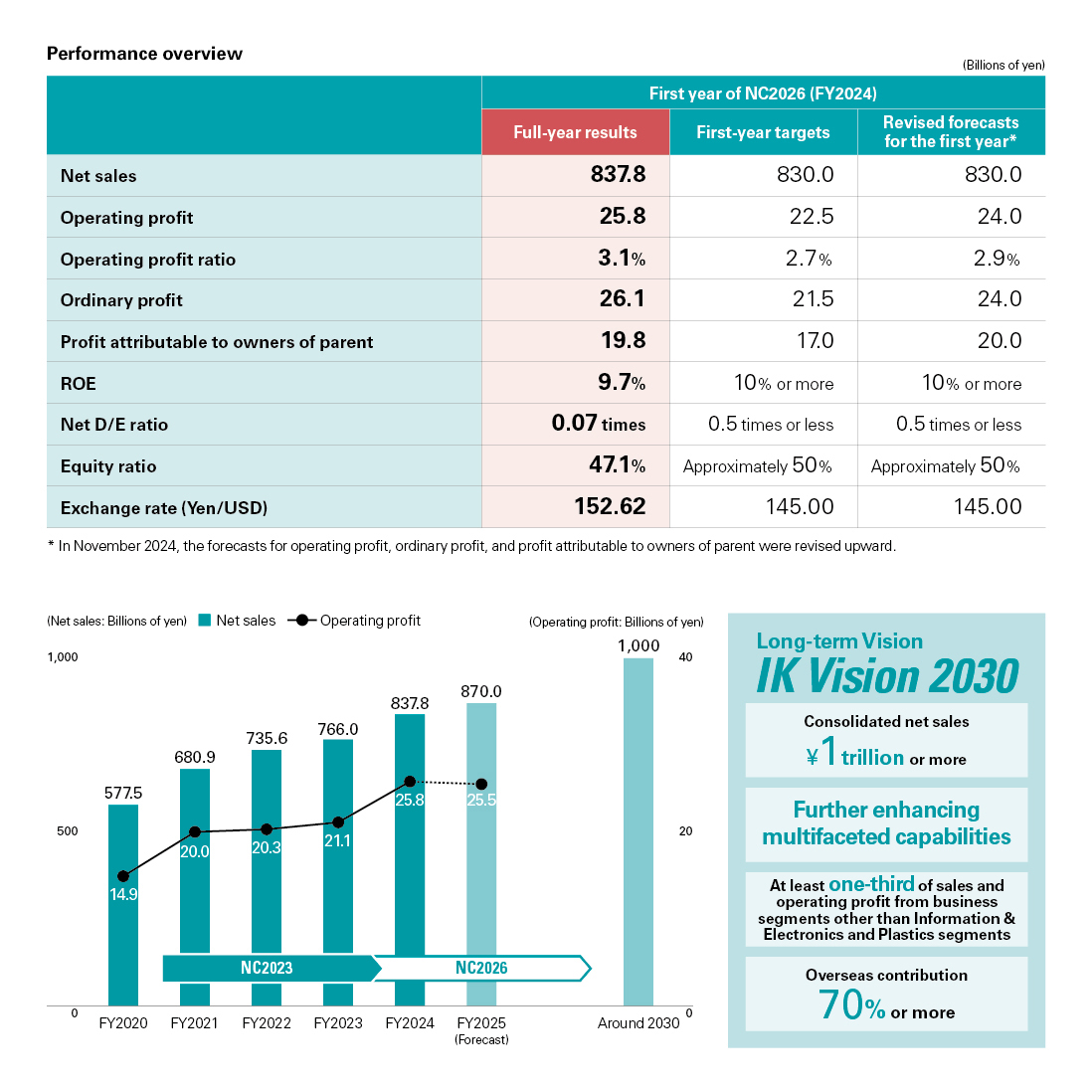

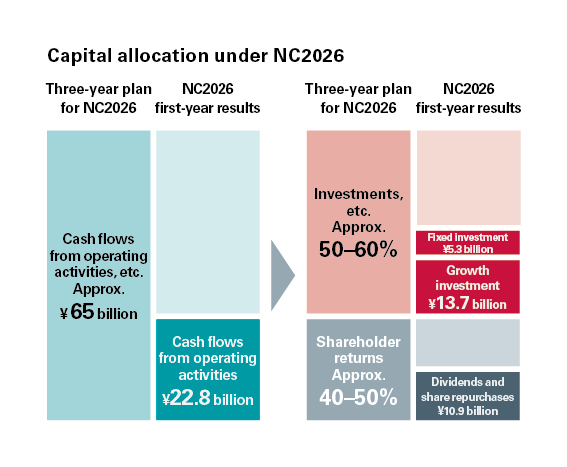

The three-year period of NC2026 centers on accelerating growth through more proactive investment. The capital allocation policy assumes approximately 65 billion yen in cash flows from operating activities over the three years, with about 50 to 60 percent of that, or 35 to 40 billion yen, allocated to growth investments. In the first year, approximately 13 billion yen was invested, including the acquisition of shares in Novacel Co., Ltd., as well as investments aligned with the company-wide growth strategy, such as enhancing multifaceted capabilities.

For the remaining two years of the plan period, we are considering nurturing new core businesses and pursuing M&A of overseas companies, with the intention of increasing the total annual investment amount. In particular, we are conducting research to successfully execute M&A aimed at driving growth in semiconductor-related materials. We will carefully evaluate the business strengths and financial conditions to determine whether potential targets can generate synergies with the Company and whether the investment amount is appropriate.

Expanding the Life Industry and Chemicals segments to build a portfolio resilient to economic fluctuations

We are making steady progress toward our goal of consolidated net sales exceeding one trillion yen under our long-term vision, IK Vision 2030. However, this progress has been aided by the weak yen, and the outlook remains uncertain. We must simultaneously expand our core businesses and invest management resources into high-potential growth areas to drive top-line growth.

Similarly, the goal of achieving an overseas ratio of 70% or more, as set forth in the long-term vision, is within sight for FY2030. Among our traditionally strong markets in Asia, India is experiencing especially notable growth. At present, the majority of our business in India involves synthetic resins. However, under the leadership of the Indian government, efforts to develop and foster the semiconductor industry are gaining momentum. In line with this development, we are planning to increase the number of on-site representatives.

Mexico, where we have developed businesses such as synthetic resins and automotive components, has recently faced growing uncertainty due to U.S. tariff policies. Even so, we continue to see it as a market with strong growth potential. This is my personal view, but I believe that the protectionist policies of the United States, which have created significant headwinds for the global economy, are not sustainable and will eventually stabilize. In addition, we have established a new base in Cambodia and started expanding into previously untapped regions, including Eastern Europe.

At the same time, as I mentioned last year, the biggest challenge lies in how we can grow businesses outside of Information & Electronics and Plastics, which are highly sensitive to economic fluctuations. By around 2030, we aim to grow businesses outside these two major segments to account for at least one-third of profits, and are accelerating efforts to achieve this goal. A prime example of this is the Life Industry segment, which handles raw materials for life sciences and food products. This is because demand for pharmaceuticals, consumer goods such as detergents and insecticides, and food items like agricultural and marine products tends to remain stable even during economic

slowdowns. In February 2025, through our Group company Daigo Tsusho, we acquired all shares of Satoen Co., Ltd., making it a subsidiary. Satoen’s main business is the cultivation, production, and sale of matcha (finely ground powdered green tea). This company has strengths in sales through e-commerce platforms and catalog mail-order services. Japanese green tea has strong brand value and its exports overseas are increasing. This trend is driven by growing health consciousness and the reassurance associated with the “Made in Japan” label. Moving forward, we plan to leverage our overseas network to expand sales in Asia, Europe, and North America.

The Chemicals segment also holds significant potential. While we have the advantage of owning manufacturing and processing facilities despite being a trading company, our greatest strength lies in our extensive network of key business partners and client base. Since our company originated from the sale of chemical products, we receive a wide range of opportunities related to the chemical industry and have earned strong trust from various chemical-related sectors as well as manufacturers of building and housing materials. These intangible assets are expected to be the driving force behind the expansion of the Chemicals segment.

We have set a goal to grow sales in the environment and energy sector within the Information & Electronics segment to around 100 billion yen by around 2030. To achieve this, we had planned sales of 54 billion yen by FY2026, the final year of NC2026. However, due to factors such as the slowdown in the EV market, we currently see this target as difficult to attain. Nonetheless, there is strong demand, and sales continue to grow, so we expect to achieve the target with a delay of a few years. On the other hand, we are seeing promising results in the recycling-related business, including recycled resins, within the Plastics segment. Our strengths include high quality and stable supply capabilities, and we are also recognized for enhancing our oversight and management systems related to chemical substance regulatory compliance. As a result, transactions with companies that choose sustainable value despite higher costs are steadily increasing. We will continue to implement effective measures while keeping a long-term view of the recycling market over the next 10 years.

In FY2024, we strengthened our organizational framework by enhancing collaboration between the Business Planning Office, which specializes in M&A, and related internal departments. We have clearly separated the teams responsible for identifying investment targets and conducting due diligence on potential acquisitions from those handling post-merger integration (PMI), ensuring they work collaboratively to carry out their tasks. Through active M&A investments, we aim to fill essential pieces for the Group’s future and build a business portfolio resilient to economic fluctuations.

Communicating recent performance and business strengths while aiming to maintain a consistent P/B ratio of 1

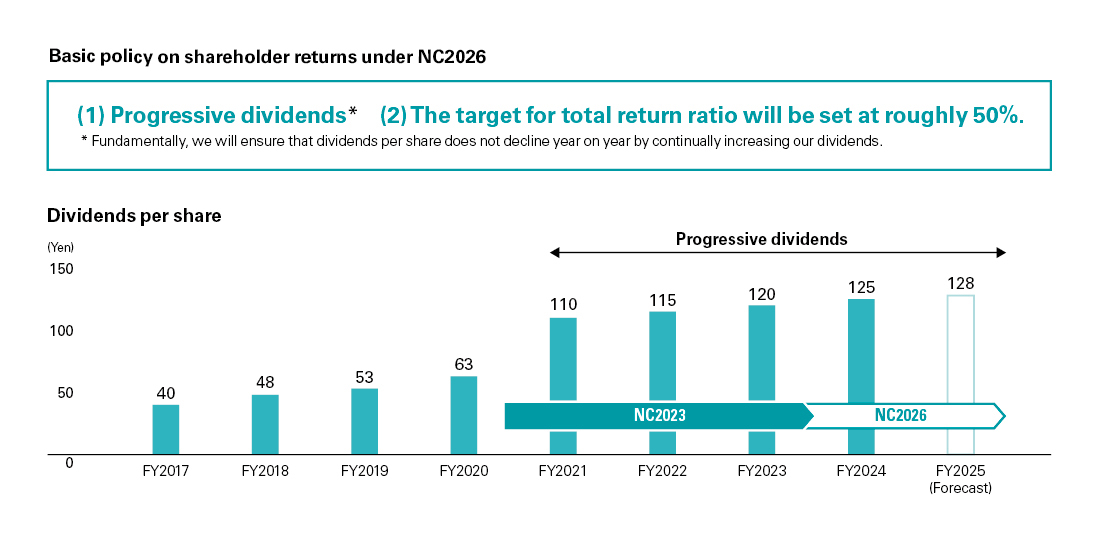

As discussed, we will strive to raise our operating profit margin by incorporating new businesses through M&A and by pursuing greater profitability within each existing business segment. As a result, we aim to consistently generate profit attributable to owners of parent, which serves as the source of dividends, and thereby reward our shareholders.

In recent years, profit attributable to owners of parent has been boosted by the sale of strategically held shares, but most of these sales have already been completed. Therefore, going forward, we will allocate profits generated from our businesses to growth investments, rather than relying on cash obtained from such sales. As outlined in the NC2026 financial strategy, we aim to maintain an ROE level above the cost of shareholders’ equity, meaning 10% or higher, while striving to achieve a stock price that consistently exceeds a P/B ratio of 1 as soon as possible. Until now, we have enhanced market valuation by implementing progressive dividends and increasing the payout ratio. To achieve a consistent P/B ratio above 1, we recognize

the need to actively highlight our track record, which includes four consecutive years of sales and profit growth, never reporting a loss on a consolidated basis since listing, and our global business foundation and information network. Doing so will help foster understanding of our performance and strengths and build confidence in our future prospects.

In addition, as part of our financial strategy, we issued the Company’s first green bond in December 2024.

The funds raised will be allocated to the construction of a biomass power plant with measures to reduce environmental impact, as well as the rebuilding of our Tokyo Head Office building, which will feature enhanced disaster resilience. We intend for the issuance of green bonds to be ongoing, rather than a one-time event. Moving ahead, we will continue to diversify our funding methods, including sustainable finance.

Advancing initiatives based on engagement survey results and further promoting local staff to executive positions

We are steadily implementing strategies to achieve the KPIs and targets set for the Sustainability Medium-term Plan 2026, which covers to FY2026, and are making consistent progress.

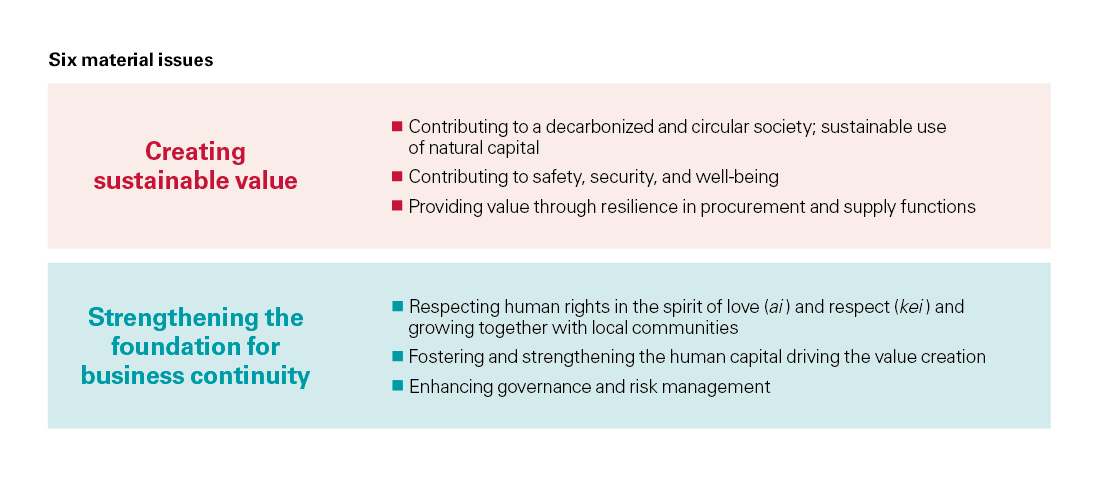

We have organized the six material issues identified in 2022 into two broad categories. The first category is “creating sustainable value,” which includes the goal of increasing sales from environment-related business to 100 billion yen by FY2026. As previously mentioned, there are numerous growth opportunities in the energy and power fields. It goes without saying that these businesses also align with efforts to reduce GHG emissions and address climate change. Aligned with the material issue of creating sustainable value, we established the Inabata Group Sustainable Supply Chain Policy in November 2024. In FY2024, we implemented a range of measures to strengthen chemical substance regulation management, with a focus on legal compliance and quality control. Because of our nature as a trading company, we believe sustainability-related risks can be limited. Going forward, we plan to clearly explain to our stakeholders why these risks can be limited, using the outcomes of our various initiatives as evidence.

The second framework, “strengthening the foundation for business continuity, ”includes conducting an engagement survey annually as a means to measure progress toward the top strategic goal of improving employee well-being. The results for FY2024 showed a slight decline in the positive response rate across all categories compared to the previous fiscal year. This time, the survey scope was expanded to include domestic Group companies, covering nearly the entire consolidated Group. We believe this broader coverage influenced the overall survey results. We have taken the decline in engagement results seriously and conducted a thorough analysis of the results. Based on the results of this analysis, we have identified key issues and implemented various initiatives, such as adjusting the focus areas of our education and training and introducing new training programs.

As part of our Sustainability Medium-term Plan, which targets the active promotion of local staff to management positions at overseas subsidiaries, we have already seen success in our Taiwanese trading subsidiary, where a local staff member has taken on a leadership role and delivered strong results. In FY2024, we appointed a local staff member as president of our U.S. trading subsidiary. This appointment served as a major source of encouragement for our U.S. local staff and contributed to higher workplace motivation. Building on this momentum, we are currently developing systems to further promote managerial appointments for local employees. At the Management Council scheduled for FY2025, we will discuss promotion rules for locally hired staff across various countries and regions, aiming to clarify and visualize multiple career paths. We will communicate this information to each location, along with frameworks that support capability development. For the Inabata Group to achieve further growth, it is essential to strengthen transactions not only with Japanese clients but also with overseas manufacturers and local business partners abroad. To become a truly global company, we plan to further promote the appointment of local staff to executive positions.

Building a new data integration platform and enhancing Inabata’s unique sales style with AI

In our digital strategy, we are focusing on strengthening security across the Group, updating core systems, and strategically leveraging sales information through the introduction of a new data integration platform and other initiatives. We view the daily reports and emails from sales representatives, along with the vast amount of electronic files created by staff across domestic and international locations, as a treasure trove. We will integrate and organize these unstructured data using generative AI.

One of Inabata’s strengths is its customer-focused sales approach. Since its founding, the Company has built trusted relationships with a diverse range of clients and suppliers through the strength of its people. We have no intention of replacing this aspect with AI, but by strategically leveraging unstructured data, we can complement our distinctive sales style with digital technology. This will increase the accuracy of sales and idea proposals while also boosting the productivity of back-office employees. Employees will be able to adopt successful strategies and ideas from other countries and regions at their own local offices, without being hindered by language barriers. We plan to establish this data integration and utilization platform by FY2026.

Discussions with independent directors on human capital Utilizing the insights to improve the design of human resources systems

In the second half of FY2024, we spent a full day exchanging views with our independent directors in a setting other than the Board meeting. The main focus of the discussions was on human capital. Inabata has grown through the strength of its people, and naturally, human capital will remain the key to its future growth. I had in-depth discussions with the independent directors from a diversity and inclusivity (D&I) perspective, covering topics such as developing sales talent, supporting the careers of women and senior employees, and promoting local staff to achieve the target of having 70% or more of our business generated overseas. As a result, we gained many valuable insights that we plan to utilize in designing our human resources systems and fostering a workplace culture where no one is left behind.

By combining the various strategies and initiatives discussed here, we will create synergies within the Group and return the resulting growth benefits to our shareholders.